Robots and automated trading

Binary options robots or "bots" have gained more popularity. Automatic

Binary options robots or "bots" have gained more popularity. Automatic

Instructions to start playing Forex stocks The first question is:

Forex Forex comes from the full word in English that

Forex and Binary Options are attractive alternatives to previously established

Forex trading is one of the most dynamic and volatile

Forex trading (or ‘foreign exchange’ or ‘FX’) is the buying and selling of one currency for another, trades are placed at an exchange rate displayed over the counter (OTC) or trading platform. forex trading

The world’s largest market sees over $5 trillion traded daily on Forex. They can be traded five days a week around the clock, there is no central currency exchange, so they are exchanged globally in different sources.

In each currency pair, the first currency listed is the ‘base’ currency and the second buy currency, so with EUR/USD the price quoted is the number of US dollars to buy 1 euro.

Almost all financial news or events around the world influence prices. forex With the market open 24 hours a day and many brokers offering low commissions, tight spreads and high leverage, forex trading has become very popular with investors. Retail, however, is still highly risky, especially when it comes to leverage.

Forex pairs are the entry point for forex trading. A ‘pair’ is two currencies to be traded, so a trader buys one currency for the other. For example, with the GBP/USD pair, a trader buys the pound for the dollar. United States

When prices are quoted, they are always the second currency bought first, for example with EUR/GBP the quoted price is the cost in pounds to buy 1 euro. used to exchange currencies for their holidays. In the EUR/GBP example, the current trading rate is 8454.8 For holiday makers heading to Europe, that equates to 84.5pence for a 1 euro purchase.

The currency of the trading account doesn’t matter if the broker converts them as necessary to enable the trader to buy or sell the currency, retail forex trading is just a projection of exchange rate movements between forex pairs.

Established pairs traded in large volumes and based on the US dollar are known as pairs. ‘Major’ In addition to the more traditional forex pairs, there are also broader currency exchanges – these are known as ‘minor’ or ‘exotic’ pairs. Between 40 and 50 different currency pairs from all over the world, emerging markets add a new element to trading. Forex These markets include regions such as South America and Asia Currencies often represent market sentiment in the entire economy of the area involved With so many factors affecting such economies it is easy to see why prices There is constant volatility.

However, minors and exotic pairs see lower trading volumes, which could affect volatility. but still exists sometimes

So what influences the market? FX? Pretty much everything. Almost every piece of news around the world can affect the price of a currency. For example, a collapse in oil prices leads to a similar decline in the value of the Russian ruble. An economy thatHeavily linked to oil will rise or fall with the value of that commodity, of course there are additional factors to consider. but a clear example

A more elaborate example is the Indian rupee.The new governor of the Reserve Bank of India boosted investor confidence in the planned recovery plan for the Indian currency.This sentiment was reflected in the rupee’s strong performance. While Indian currencies benefited directly, other Asian currencies also gained as regional performance helped both the Philippine peso and the Thai baht.

Another example is foreign policy: if a country like China were to broker a deal with Russia on gas, both currencies could benefit if the market believed that one partner had the better side of the other currency deal. While another country suffers, traders may look at future foreign policy and invest accordingly, these examples are clearer and larger market drivers. But it illustrates the fact that forex is a very complex market.

Uncertainty in markets often leads to volatility The global economy is undoubtedly unstable right now, which means there are plenty of opportunities for traders. Forex binary options offer an opportunity to profit from uncertainty. The range of forex currencies available to trade through binary options brokers has never been larger and the strategies are valid for those currencies. Properly able to prove very profitable, our review highlights those brokers that focus on forex binary options.

Some beginners skip the forex basics and go straight to strategy, that can be a mistake and lead to many lessons learned the hard way. One of them is to know when certain markets will open.

The forex market is open 24 hours a day. This is because banks and companies open at different times around the world. This demand provides liquidity to the pair. but each hour of the day tends to differ based on the part of the world that is open to business, understand forex market hours and hourly trends and you will be able to better implement your strategy at the right time.

Major markets open at different times throughout the day. Which markets are open directly affects liquidity and volatility and forex pairs.

EURUSD, for example, is most liquid and volatile during the London and New York sessions, especially during the “overlap” period when London and New York are trading.

The USDJPY tends to be most volatile when Tokyo first opens and when New York opens several hours later.

Currencies typically see increased liquidity when one or more markets trade or actively use that currency open for business.

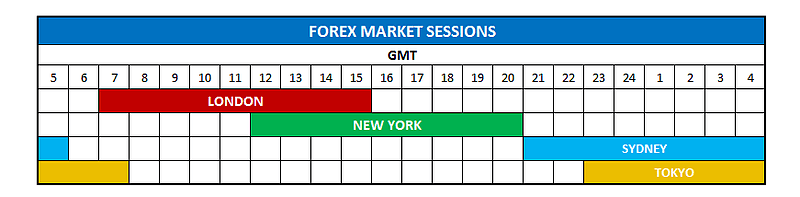

This is a GMT trading session for UK traders.

The chart does not show all markets in the world but what is shown are the main markets of Canadian forex markets open while New York opens and London overlaps other European markets.

Germany opens an hour before London, so some people assume it will be the open and not the start of the London session, average volatility will not see a mark up until London opens.

Those key periods directly affect the currency pair volatility, hourly volatility follows a certain trend, if your strategy is based on volatility or you are using a trending strategy, focus on the period of Date of biggest price movement

If you use a more diversified trading strategy or prefer low volatility, trade during calm hours, check the chart showing hourly drop in volatility.

08:00 to 17:00 GMT gives best opportunities generally 13:00 to 17:00.

Those looking for lower volatility or a tendency to stay quiet have trade between 20:00 and 05:00 GMT.

The USDCHF is very similar to the EURUSD in terms of its hourly volatility structure, although the USDCHF moves less overall on a daily basis, so overall hourly volatility is several points less.

The NZDUSD has very similar hourly volatility to the AUDUSD and they both move about the same amount each day.

Learning the basics such as market periods and time, what they mean to you as a trader, can be a huge help in strategies and timeframes. Determine the type of market you want to trade, don’t try and force trades, this will help filter out trades and cashing in on good opportunities.

The main advantage of binary options over forex trading is the loss imposed and Limit what you can do from any trades. When you buy binary options you know at the beginning what will be your maximum loss, it is determined by the cost of the option itself, you can also determine Forex trading loss of you by adding a stop loss order to your position. But two things can come into play.

In other words, it can also be used for disciplined risk management, traders often face difficulties in trading which can be disastrous, with binary options your maximum loss is always fixed and No more risk of losing

This ties into the concept of volatility, with Binary Option it doesn’t matter how the market moves as long as it ends up with money expiring whereas having a Forex presence usually sees you losing money due to to the high volatility of the market – then watch the price movement in your favor.

While both trading methods use a number of common features. But there are additional elements that set it apart:

Binary options allow very short expiries. With only a few minutes to exist, in fact, even a couple of sixty expiration in the forex market, it is very difficult for the market to move enough for you to close your position in a matter of minutes. Let alone in just sixty seconds, since payouts for binary options range from 75% to 90%, you can buy an option for let’s say £200 and earn between £150 and £180 profit after that. just a few minutes

With Forex trading, you enter a position with the aim of reaching a certain target price level that will inevitably be away from the current price. Silver options at expiration With forex target prices potentially far from the current market price, a larger price move is necessary to keep profits at the same level.

In Forex if the current market price for EUR/USD is 1.1200 you enter the trade with the idea that the market will go up or down let’s say 20 pips whereas in Binary Options the strike price will be the current market price of 1.1200 and the option of you It must be 1 pip above or below that price for you to cash in.

The biggest drawback when trading binary options is that you need to use the win rate, in forex trading if you use the risk/reward ratio correctly your profits are usually higher than your losses. You This is because you should enter each trade with a higher target Profit than Stop Loss i.e. 35 pips vs 25. This means that even if you are right only 50% of the time you should make money i.e. Your winning trades will earn more than losing trades.

This concept doesn’t apply to binary options and it’s easy to see why, with payouts of about 75-90%, traders must win more than 50% of their trades in order to make a profit with the trade. Each time more money is risked than it gets in case of a money option, in this situation you have to get it right more than 50% of the time to get the overall profit.

Also, binary trading does not have a real secondary market, once you have purchased an option you may want to exit it before the expiration date – you may try to minimize your losses or increase your profits if you think that The market is changing, so you may find yourself wanting to sell the option you bought, in doing so you only have the option to sell at a price that is shown to you by the broker from which you bought the option.

While you can have different accounts with different binary options brokers and compare the prices of the options you want to buy before actually buying them, when you are in a trade if you want to relax it, that’s a turn off. Trade before it actually expires, you have no choice but to follow the price shown by the broker. In Forex, of course, the market is freely priced at any given moment and you know you will get a fair market price to exit your trade. not broker price

Which trading option is the best choice in the most profitable market? Forex? depends greatly on your level of commitment in terms of hours per day in front of your screen and risk management discipline.

With binary options, you may not need to be in front of a screen for hours a day to constantly monitor the market as needed when trading. Forex you can hold your position and wait for the result.Rest assured that your maximum liability is the cost of the option, you don’t have to worry about maintaining your Stop Loss level, it will be fixed at the price you paid for the option and cannot be changed.

One thing that is common to both markets is the analysis required to make trading decisions, whichever market you are going to trade in, you will always look at fundamental knowledge and/or technical analysis for both markets. will need to hone your analytical skills and create a trading plan or profitable strategy.

Here, a professional trader and founder of a money management and trading advisory firm shares his thoughts on the basics of forex binary options trading and the systems he personally uses.

The strategy below is not a secret. But it’s not known either: simplicity is the reason for its success.

The currency pair that I generally trade is the EUR/USD pair. This is because it is the most volatile pair. It is still the most traded pair since the opening of the Forex market to retail investors, the daily volume has increased dramatically since the early days, EUR/USD is a pair used by financial firms to hedge. Risk of market volatility

One issue that is regularly cropping up in binary options forums is the amount of different strategies that are mentioned or presented, most traders think that the more complex the system, the more profitable it is. When these forex strategies fail, the system is to blame. However, the real problem lies behind the screen. There is no strategy to adapt to changing market conditions. Traders must adapt.

Many argue that this strategy will not work in specific market conditions, the point is that the market is binary, the price only goes up or down, physical markets don’t exist, any system has the same ultimate goal – to detect a move. Best entry and exit points for any trade

For example, an experienced trader will easily detect support and resistance, a beginner may not, the same novice investor may use a strategy that uses:

…but what they fail to see is that these indicators provide him with the same entry points that traders use.

When trading forex binary options, finding the best entry point and knowing the next price move is key.

Note: Below are my personal opinions and strategies that I personally use, everything should be read carefully, do not jump to high-risk methods without a complete understanding of how to use the strategy, consider trading with a demo account first. Risk real money, be prepared to pass trades if something dislikes you, don’t force trades when no opportunities come.

The first point is to offer a general description of the forex market: currency exchange is governed by the laws of supply and demand.

Here’s a hypothetical example: Apple (a company based in the US) sells 1 million mobile phones across Europe for €500 per product. EUR (€) is their base currency. They use HSBC for debiting, so they get paid. These, however – Apple reported in dollars and the account maintained with the BOA.

So Apple made 500 million euros which was in HSBC account in Luxembourg, now those funds need to flow into BOA account and convert to USD.

Now they have to exchange currency, transfer orders come in on Tuesday at 4:00 PM UK time, it will not be transferred immediately, the bank collects all USD orders during the night, these may arrive last month. already

The UER/USD pair is trading on Wednesday morning, 6 GMT at 1.27000, so Apple’s account with BOA will receive $635 million at 8:00 AM. 1.27000 How does a bank – or individual investor make money from this transaction?

BOA obviously gets a commission from Apple, but what is HSBC?

At 8:00 AM GMT – opening of the London market, the liquidity is 380 million euros, the price is 1.27010 so 500 million Euro is equivalent to 635 050 000 USD currently the market can’t handle this trade.

Let’s expand hypothetically, this is the nature of the market, the euro trend is up, Asian markets rise overnight, the US fiscal cliff is being resolved, millions of retail investors and merchants take orders and stop at 10. pips Under current prices, there is now 300 million Euros of liquidity pending plus 380 million euros of current liquidity. action (equivalent to stop)

Market data shows that stops are at 1.26910, so at 8:15 GMT the buy order sells the available liquidity (840 million euro sell order). The effect of this is to drive the price to 1.26905 Now the bank order is triggered, another retail investor has made a new order to cover the loss.

The price flew to 1.27099, here we may exit our buy positions gradually. (assuming we follow the bank trades) Since the trend is still strong, people buy our orders, in this chart this may be represented by smaller green candles after the trend is up.

Market liquidity increased to 380 + 300 = 680 million euros. We exited at 1.27099 for a profit of 9.9 pips (from 1.27000).Take advantage and scale of these trades – huge amounts of money have already changed hands. Banks. Many traders (and retail investors) have taken advantage of leverage to make huge profits from such moves.

These are all examples, the fact is that the volume is huge (4 trillion USD daily), there are many traders, market makers and stakeholders in these markets. But this example shows you how FX works and this is fundamental to analyzing support and resistance (SR) levels and trends.

These levels are set by larger players, they are still good because retail investors spot and use them, the smart money cycle happens in 3 price cycles, then we see a short channel at the price. Stuck to accumulate strength

These price cycles are not random, they follow a sequence, this sequence is determined by a set of numbers known as Fibonacci numbers.

Fibonacci numbers were not developed for commercial purposes, they occur globally in nature which can explain biological systems in terms of the Fibonacci sequence.

big forex traders Most traders (including banks) do not use indicators such as RSI, CCI or MACD. They use a system based on Fibonacci numbers.

Combining Fibonacci with accurate price channel calculations and information about other people’s trades, you have a profitable trading strategy for forex.

Why do you need to consider all of this when trading binary options?Unlike spot foreign exchange, you need to be right more often.You need to specify the direction, not the size of the move.

During today’s trading it will not be relevant to the big trade shown above, I need a bag of price action (and pips) so I need to use what finds these price action cycles and reversals. and spot fx day trading) I use 3 indicators with very precise functions.

Forex correlations are important tools if you don’t learn them – it can harm your trade. Correlations show which pairs move against each other. It also indicates where they move in the opposite direction. It doesn’t matter if it shows. unrelated couple

All of these help determine which trades we should take, can reduce risks and even provide additional trading opportunities that are not obvious on the price chart.

Usually shows a correlation with values ranging from -100 to 100. A value of -100 (inverse correlation) shows two forex pairs moving in opposite directions, if one rises the other falls and vice versa. Even if two forex pairs move together, if one falls, the other will rise, similarly if one falls, the other will, numbers at the extremes of the spectrum are rare – but closer to -100 or so. 100 The more relationship

Therefore, numbers greater than -/+70 are a notable correlation, anything greater than -/+80 being a strong correlation, considering the GBP/USD and EUR/USD crossover above, it shows numbers between GBP/USD and EUR/. USD at 89.6, this shows a strong correlation.

Then judge USD/CHF with EUR/USD. It shows that the correlation between these two pairs is -95.4 This shows a very strong inverse correlation. As EUR/USD rises, USD/CHF falls and vice versa.

There are many pairs, no correlation is involved, in case the value (positive or negative) is less than 60, the correlation is not very strong, anything around 0 indicates that there is no correlation between the pairs, for example NZD/USD and EUR/USD pairs are correlated. This relationship is -1.7 This means that there is no visible day-to-day correlation between these pairs, in other words, the rise or fall of NZD/USD doesn’t tell us exactly what EUR/USD might do.

Correlation tables are created and updated on hourly, daily and weekly timeframes, all these timeframes provide valuable information depending on the timeframe you trade, for short-term trading hourly and daily correlations will. Most importantly, the numbers change, so don’t take the above as gospel.

There are many reasons to be concerned with forex correlations, the best reason I review them is risk control, for example a trader may assume that trading multiple pairs offers diversification, there is only certainty in the Knowing only related couples

If you go long (buy calls) on EUR/USD, GBP/USD and sell (buy calls) USD/CHF, you get 3 very similar positions. If someone moves against you, they tend. To oppose you, the risk is tripled, if it is leveraged, the risk is large.

Another reason forex correlations are important is that they can provide you with trades that you may not have seen before, for example you believe the Euro will appreciate against the US Dollar (i.e. the EUR/USD will You look at the chart and don’t see a good trade setup, since you know that GBP/USD generally moves with EUR/USD (based on current correlation), you can check GBP/USD to see if Is there a better trade setup?

You may want to see if there is a trade setup to go short (buy put) on USD/CHF as it tends to go in the opposite direction of EUR/USD correlation is high. (positive to negative) allows you to trade options, choosing the ones with the best trade setups.

I want to use the relation ofForex to confirm a trade When searching for a highly correlated forex pair, I would use one to confirm a trade in another. For example, if EUR/USD is rising and I want to go long (buy call), I would like to see. The rise of GBP/USD as these pairs are highly correlated they should move together, when they don’t it reminds me that maybe I should look more closely at my trade. I won’t trade, these relationships have changed and the two pairs have never moved perfectly in harmony, it means I have a very good reason for trading. (as you should)

Correlation can be a complicated statistical topic, hope this introduction gives you enough ideas to do your own homework, check correlation regularly to get an idea of how correlations between forex pairs might affect your trading.

Use correlation data to control risk, find opportunities, and filter trades. If you’re having trouble seeing how correlations work, look at the numbers in the correlation table and pull up the price charts of the two forex pairs in question. Notice how the pairs move relative to each other. How does this help build a general understanding of correlations?

A “swing” trade is generally a trade that is open for between one and five days, traders attempting to follow the momentum of the asset price, often within an established trend channel.

The concept of “swing trading” originated from the stock market and is a type of trading strategy followed by most retail traders, the reason why it is difficult for institutional traders to position the size they want without moving the market.

This may not be true for the Forex market as major pairs are very liquid and there are many interbank markets that traditionally oscillate the trading positions themselves in terms of duration between day traders and intermediate traders or traders. Days hold positions for a few seconds or hours at most, while mid-term investors may hold positions for weeks.

However, the Forex market is a different kind of ball game. Even in the wildest bull trend or the wildest bear trend, you may still find that today’s price action passes through a few highs and lows instead of heading in one direction throughout the day.

Swing traders in the Forex market may also be day traders, trying to take advantage of price momentum in downtrends and upsides. go up But it goes short as soon as the market swings again to the downside.

Swing traders, due to their short holding periods, are not interested in fundamentals and focus mainly on technical analysis, can be as simple as the 3-day average crossover strategy modified to Premature entry and exit, or a more complex mix of technical indicators overlap.

In any case, the intention is the same: to gain early when the momentum changes and to change positions when the market reverses, this strategy works especially well when the market is trending sideways rather than up or down. The Forex market has many swings even though the market is clearly trending. But trying to sell in a strong bull market early enough to catch a swing could prove painful.

Defining the right market

Determining whether the current market is suitable within a given time frame is crucial to the success of this strategy, you need to consider how long your trading in the Forex market takes place on a shorter time frame, so it is important to stick to the timeframe. Where you are trading to see if the market is trading sideways, a sideways market is defined when the highs and lows do not cross the previous highs and lows, forming a so-called channel like other chart patterns. other

The shorter the time frame, the smaller the difference between the high and the low or the shorter the price action channel. 2% to 6%. In comparison, if you’re looking at the channel hour chart, it’s probably more than 0.5% to 1.5%. Often, sideways markets in less than a day’s time can move in very narrow ranges as the market consolidates new levels. together

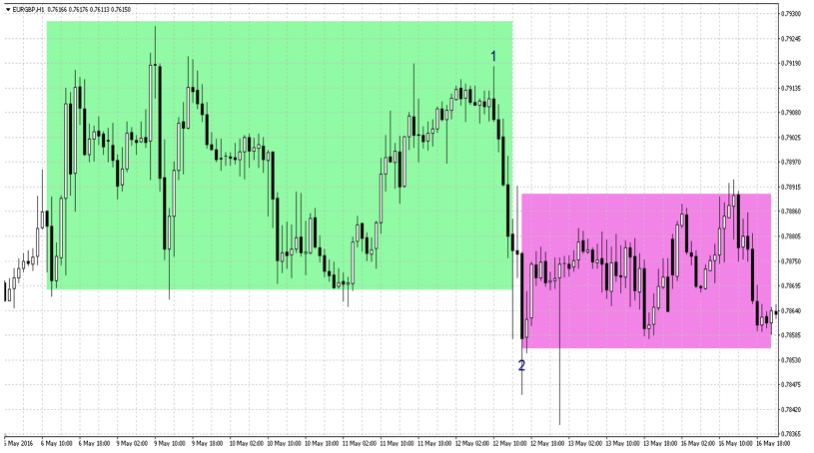

Let’s look at a couple of examples.

The hourly candlestick chart in the first picture is for USDCHF. As we can see, the pair went through a pretty tight price range of about 45 pips between 0.98800 and 0.9925, the blue rectangle that started from May 19 06:00 to May 24 time. 03:00 GMT emphasizes that price action persists throughout that time, then a swing trader’s job is to try to go short or sell at points A, C and E and go long or buy at point B. , D and F

In swing trading there is no downtime, the strategy consists of continuously going long or short so there is no close and wait period which is useful when the market resumes trading allowing you to get back into the market at a price. Better than you ever exited, however, it can be excruciating if the trend is sharp and continuous.

Therefore, it is necessary to find breakpoints of the price movement and the development of increasing momentum in one direction.In fact there is a break out of the channel pattern, the last three of the four bars close above the blue rectangle which should raise a red flag to swing traders, the side action may not turn into a new uptrend, however the fact that price has moved above its channel should create caution, it will have to wait and see if the market has found new momentum or just a higher top of the channel.

The hourly chart in the second image for EURGBP shows how price action moves from one side channel in the green rectangle to another lower side channel in the pink rectangle as price moves from point 1. Still at point 2, it may be tempting to open a short position at point 2 with the view that a new bearish trend is in progress, only to find that prices are making a comeback and trade within the range.</p > As always, caution must be exercised in the end. But even if you’re not a swing trader identifying sideways markets will help you avoid getting caught swinging, identifying the correct market regime will help you avoid buying when the market is about to close or selling when it’s closing. The market is about to fall back.