How to earn your first income by trading on IQ option

The first way to earn money by trading on IQ

The first way to earn money by trading on IQ

Exnova - Best Options Strategy It was developed by strategy

An option is a derivative contract according to the conditions

This is a question that many traders ask themselves after

Welcome to our Binary Options Strategies section, here you will

Day trading strategies are essential when you want to invest in small and frequent price movements. A consistent and effective strategy relies on in-depth technical analysis, the use of charts, indicators and patterns to predict the movements of the day. Future Prices This page will provide you with a detailed description of beginner trading strategies, advanced strategies, automation and even asset specifics.

It will also outline the regional differences to be aware of as well as point you in the direction of useful resources, although ultimately you will need to find a day trading strategy that fits your specific style and needs.

Also make sure you choose a broker that suits your day trading strategy, you will need things like;

Visit the brokers page to make sure you have the right partners in your brokerage.

Before you get bogged down in the complex world of advanced technical indicators, focus on the basics of a simple trading strategy. Many people make the mistake of thinking that you need a highly complex strategy to be successful during the day. But often the more straightforward, the more effective.

Incorporate the valuable elements below into your strategy.

Whether you’re using an automated trading strategy or a beginner and advanced strategy, you’ll need to keep three key components in mind: volatility, liquidity, and volume, if you want to make money on small price movements. Proper fitting is important, these three elements will help you make a decision.

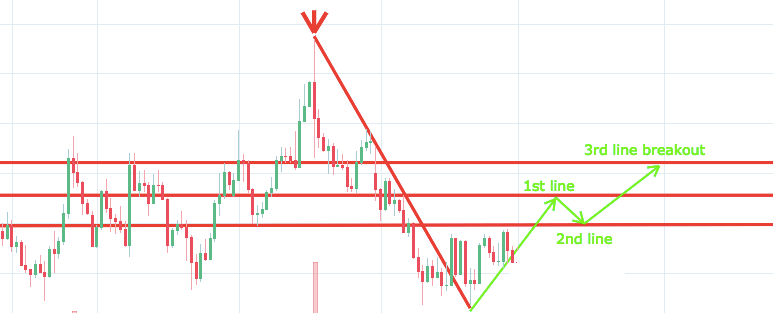

The breakout strategy is centered when the price clears the level indicated on your chart with increasing volume, the breakout trader enters a position long after the asset or security breaks the resistance, or you enter a short position when Share price breaks support

After an asset or security trades beyond a certain price, volatility usually increases and prices tend to tend in the direction of a breakout.

You need to find the right instrument to trade, with this in mind, the support and resistance levels of the asset should be taken into account, the higher the price is above these points, the more validated and significant they are.

This part is nice and straightforward, the price is set to close and go above the level.Resistance requires a bearish position, price set near and below the support level requires an upward position.

Use the asset’s recent performance to set a reasonable price target Using chart patterns will make this process more accurate You can calculate the average recent price swing to create a target if the average price swing is 3 points over multiple price swings. Until then, this would be a reasonable goal, once you achieve it, you can exit the trade and enjoy your profits.

One of the most popular strategies is scalping. It is very popular in the forex market and appears to invest in minute price changes. The driving force is volume. You will immediately look for a sell on the trade. Take Profit This is a fast and exciting way of trading. But it can be risky, you need a high trading opportunity to get a low risk versus reward ratio.

Get ready for volatile instruments, attractive liquidity and hot in time, you can’t wait for the market, you must close losing trades as soon as possible.

Popular among beginner trading strategies, this strategy revolves around acting on news sources and identifying major moving trends with high volume support, with at least one stock moving about 20-30% each day. So chances are enough, you just hold on to your position until you see the signs of a reversal and leave.

Alternatively, you can remove the falling price, this way your target price will be close as soon as the volume starts to decrease.

This strategy is simple and effective if used correctly, however you need to make sure you stay up to date on news and upcoming earnings announcements, just a few seconds on each trade will make a difference to your profits over time. end

Although it is hotly debated and can be dangerous when used by beginners. But it is also used globally reversal exchange, it is also known as trend pullback trading and mean reversal strategy.

This strategy defies basic logic, as you aim to trade against the trend, you need to be able to accurately identify possible pullbacks as well as predict their strength, to do this effectively you need knowledge and experience. in-depth marketing

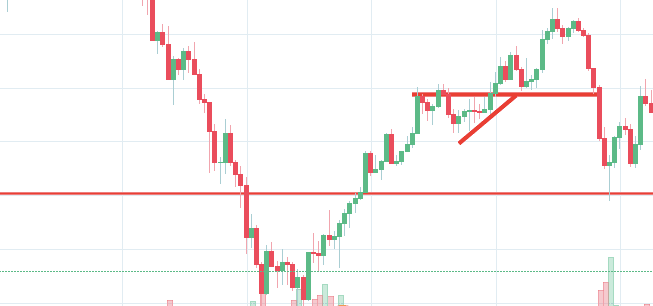

Strategy ‘Pivot of the Day’ It is considered a unique case of retracement trading as it is central to buying and selling pullbacks/retrace lows and daily highs.

The one-day pivot point trading strategy can be great for identifying and taking action on major support and/or resistance levels.It is especially useful in forex markets.It can also be used by traders who have Boundaries to identify entry points, while trend and breakout traders can use pivot points to find key levels where breaks are needed for a move to count as a breakout.

The pivot point is defined as the pivot point, you use the previous day’s high and low prices as well as the security’s closing price to calculate the pivot point.

Note that if you calculate pivot points using price data from relatively short timeframes, accuracy tends to decrease.

So how do you calculate the pivot point?

You can then calculate the support and resistance levels using the pivot points, to do that you will need to use the following formula:

The second level of support and resistance is calculated as follows:

For example, when applied to the FX market, you will find that the trading range for the session usually takes place between the pivot point and the first support and resistance levels, as many traders play in this range.

It is also worth noting that this is one of the systems and methods that can be applied to indices as well, for example it can help create an effective S&P trading strategy.

This is especially important if you are using margin requirements which are often high for day traders, when you trade on margin you are more exposed to price movements, yes this means profit potential. more It also means the possibility of significant losses, fortunately you can use Stop Loss.

The stop-loss controls your risk, on short positions you can place a stop-loss above the recent high, for long positions you can place it below the lows, you can also make it depend on volatility.

For example, the stock price moves 0.05 pounds per minute, so you place a stop loss of 0.15 pounds from your order to allow for swings. (hopefully in the expected direction)

One strategy that has beenA popular way is to set up two stops firstly you place a physical stop loss order at a specific price level this will be the capital you can afford to lose secondly you create a mental loss place this At this point your entry criteria is violated, so if the trade causes an unexpected turnaround, you will need to exit quickly.

Forex strategies are risky in nature as you need to accumulate your profits in a very short time. You can apply any of the above strategies to the forex market or you can refer to our forex page for detailed strategy examples.

cryptocurrency market Exciting and unpredictable, it presents many opportunities for day-to-day traders, you don’t need to understand the complex technical make-up of bitcoin or ethereum, and you don’t need to have a long-term view of its possibilities. Use straightforward strategies to profit from this volatile market.

To find specific cryptocurrency strategies, please visit our cryptocurrency page.

Daily trading strategies for stocks are based on many of the same principles outlined on this page, and you can use many of the strategies outlined above.

You will need three moving average lines:

This is one of the moving average strategies that generate a buy signal when the fast moving average crosses the slow moving average, a sell signal is generated when the fast moving average crosses below the slow moving average.

Thus, you will open a position when the moving average crosses in one direction and you will close it when it crosses in the opposite direction.

How do you create a trend?You know the trend is open if the price bar remains above or below the 100 period line.

For more information on stock strategies, see our stocks and stocks page.

Spread betting allows you to speculate on a large number of global markets without owning the asset, in addition the strategy is quite straightforward.

If you want to see the best day trading strategies revealed, take a look at our spread betting page.

Developing an effective day-to-day trading strategy can be complicated, however, choosing tools such as CFDs and your job can be quite simple.

CFDs are related to the difference between trade ins and outs, over the past year they have seen an increase in popularity, this is because you can profit when the underlying asset moves according to where it takes place without having to own the underlying asset.

For CFD specific day trading tips and strategies see our CFDs page.

Different markets come with different opportunities and obstacles to overcome.Day trading strategies for the Indian market may not apply when you use them in Australia.For example, some countries may not trust the news, so the market may not react in one way. with what you expect to return home

Regulation is another factor to consider, Indian strategies may be tailored to specific rules such as high minimum balances in margin accounts, so get online and check vague regulations won’t affect your strategy first. that you will bring your hard earned money to the line

You may find that different countries have different tax gaps to skip if you live in the West. But want to implement your normal trading strategy in the Philippines, you need to do your homework first.

What kind of taxes do you have to pay, are you going to pay it abroad and/or domestically?

The strategy takes into account the risks, if you don’t manage the risks you will lose more than you can afford and be out of the game before you know it, this is why you should always use a stop loss.

The price may look like it is moving in the direction you expect. But can reverse at any time Stop-Loss By controlling that risk, you will exit the trade and incur minimal losses if the asset or security fails.

Savvy traders usually don’t risk more than 1% of their balance on a single trade, so if you have a £27,500 account you can risk up to £275 per trade.

It also allows you to choose the perfect position size. Position size is the number of shares used in a single trade. Take the difference between your entry and stop loss price. For example, if your entry point is £. 12 and your Stop Loss is £11.80, your risk is 0.20 per share.

Now to determine how many trades you can take in a single trade divide £275 by 0.20 you can have positions up to 1375 shares. That’s the maximum position you can take for a 1% risk limit.

Make sure there is enough volume in the stock/asset to absorb the position size you are using.Also note that if you use a position size that is too large for the market, you may experienceSmooth entry and stop loss

Everyone learns differently, for example, videos find day trading strategies most helpful, this is why a number of brokers offer multi-day trading strategies in easy-to-follow training videos. Learn and Resources section to see what’s on offer.

If you are looking for the best day trading strategies that work sometimes, online blogs are the place to go, often free, you can learn intraday strategies and more from experienced traders. good inspiration

Some people will learn best from forums. This is because you can leave comments and ask questions. Also, you will often find day trading methods so that it is easy for anyone to use. However, due to the limited space, you will Only the basics of day trading strategies are given, so if you’re looking for more in-depth techniques, you may want to consider alternative learning tools.

If you want details of the best day trading strategies, PDFs are usually the place to go, their first benefit is that they are easy to follow, you can open them while you are trying to follow the instructions on the chart. your own candle

Another benefit is how easy they are to find, for example you can search for day trading strategies using price action patterns, pdf download with a quick google, they can also be very specific, so searching only for commodities or forex. Rex PDF is pretty straightforward.

You will also find that they are geared towards traders of all experience levels, so you can find beginners PDFs and advanced PDFs, you can find country-specific options such as daily trading tips and strategies for India PDFs.

Having said that, the PDF file won’t fit into the descriptions of many books, the books below offer detailed examples of intraday strategies, easy to follow and understand, making them ideal for beginners.

Therefore, day trading strategies books and ebooks can seriously help improve your trading performance.

Others will find interactive and structured courses the best way to learn, fortunately now there is a range of online places that offer such services, you can find courses on day trading strategies for commodities. Commodities, where you can walk through crude oil strategies, alternatively you can find FTSE, gap and hedging daily trading strategies.

If you are looking to do your day job and start trading for a living then you will have a challenging and exciting journey ahead, you will need to be prepared for advanced strategies including risk and money management strategies. To be effective, discipline and understanding of your emotions is essential.

For more information visit the page. ‘ Trading for Life ‘ our

Profits at your end will depend heavily on your employing strategy, so it’s worth remembering that it’s often a straightforward strategy that proves successful whether you’re interested in gold or the NSE.

Also, keep in mind that technical analysis should play an important role in validating your strategy.Also, even if you opt for either an early entry or end of the day trading strategy, controlling your risk is important if you still don’t. Want to have cash in the bank at the end of the week, ultimately developing a strategy that works for you is practice.