BitcoinIt is one of the biggest buzzwords in the financial technology industry right now. But it’s also one of the least understood, with cryptocurrencies back again, now is a better time than ever to dig into the weeds and learn more about how to invest.If you’re standing, sit back. Because here are all the details you need to know before buying your first bitcoin or deciding not to.

Investing in cryptocurrencies and Initial Coin Offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the author to invest in cryptocurrencies. Because each individual situation is unique, a qualified professional should be consulted before making any financial decisions. makes no representations or warranties as to the accuracy or timeliness of the information contained herein. Date of writing this articleNo author cryptocurrencies

Why do people buy? Cryptocurrency

You don’t have to understand bitcoin to realize that bold and brazen business banks are being cheap. In 2016, the price of bitcoin was $710.09 on February 21, 2019. The exchange rate for a single bitcoin was $3,890. It doesn’t take economic knowledge to know that people who invested in bitcoin a few years ago are now pat yourself on the back But the good news is that it’s not too late to get into the game.

It may seem hard to believe that digital currency can be worth thousands of dollars, after all, unlike physical currencies like precious metals or printed money, bitcoin is just a line of code.

Currency value

The value of the currency used to be determined by the precious metal For example, from 1879 to 1933, an American could trade the US government $20.67 for an ounce of gold. Rising Unemployment and Rising Deflation 1933 In President Franklin D. Roosevelt decided to effectively sever US ties with gold, allowing the Federal Reserve to pump more money into the economy than the government would have gold back.

The United States currently has what is known as a “fiat” monetary system, which means that the value of the dollar is determined more by faith than by physical assets. For example, the dollar is worth more than the value of ink and printed paper.

Important issues

- Bitcoin is a cryptocurrency that promises lower transaction fees than traditional online payment mechanisms.

- The value of bitcoin depends on investor confidence, the integration of cryptocurrencies with financial institutions, and public willingness to learn.

- When someone pays for an item using bitcoin, the computer on the bitcoin blockchain quickly verifies that the transaction was valid.

- Consumers who want to trade bitcoin need a place to store it – a digital wallet and connect it to their bank account, credit or debit card.

- Traders can join exchanges or online marketplaces to exchange bitcoin for traditional currency

The principle of Bitcoin

Bitcoin functions according to the same command principle as the US dollar, although the lines of code that make up bitcoin are worthless in and of themselves. But international markets value bitcoin for thousands of dollars. That’s because bitcoin is scarce and difficult to acquire over time. Here’s why:

When the bitcoin program was launched on January 3, 2009, bitcoin was minted at a rate of 50 bitcoin every 10 minutes, or 7,200 bitcoin every day. As of February 2019, 7,200 bitcoin would be worth approximately $28 million. worth a few cents

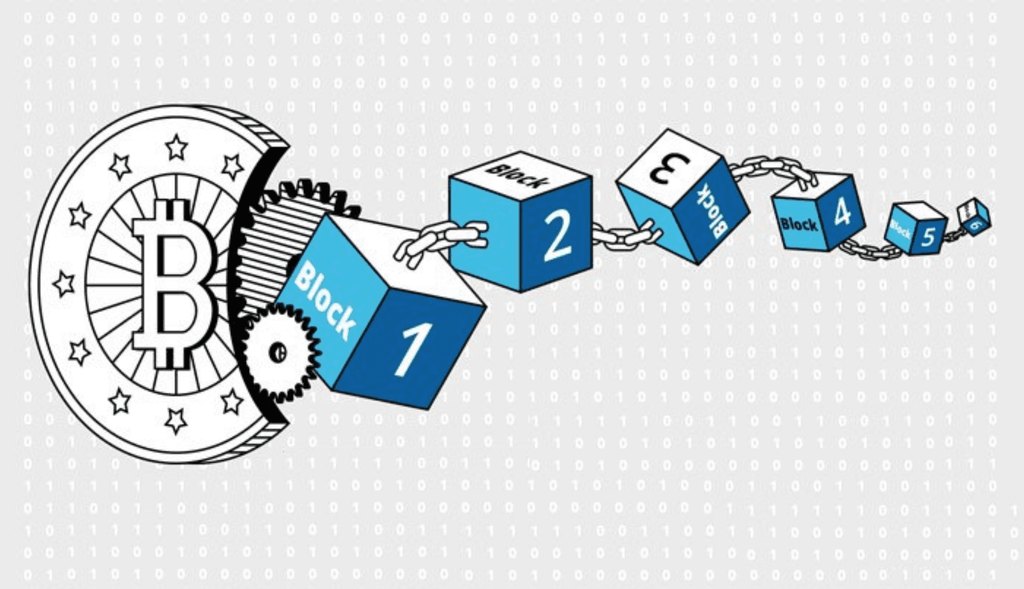

However, according to the bitcoin program, the rate at which bitcoins are produced is halved every four years, for example on Nov 28, 2012, the production rate went from 50 to 25 bitcoins every 10 minutes, or 3,600 bitcoins every day. Again July 9th 2016 it is 12.5 Bitcoin every 10 minutes and is expected to halve for four times sometime in the year. 2020 At this rate, the total number of bitcoins in circulation will approach the limit of 21 million.

The act of becoming rare

Due to the rate at which bitcoin production can be cut in half every four years, the currency becomes harder to obtain over time, as of February 2019, 17.37 million or 82.70% of all bitcoins have been generated. Bitcoin exceeds its minable rate, the price will go up, does that mean investing in bitcoin now should be a sure bet to pay off four years of debt, right?

If you’re anything like me, chances are your eyes are staring at cautionary tales, words of wisdom, and long-winded explainers that are all well and good for the real world. But when it comes to buying and selling cryptocurrencies, the most valuable investment you can make is time. is unpredictable even by popular people. Bitcoin Although bitcoin is worth $3,890 today, it was worth $19,783.21 on December 17, 2017.

Settings on Bitcoin

The value of bitcoin depends on (a) investor sentiment (b) the combination of cryptocurrencies. In today’s financial institutions and (c) the public’s willingness to learn and use new forms of currency, research is key when you invest in stocks. But it’s a lifesaver when you invest in cryptocurrencies, that’s why we’ve taken the time to explain the technology behind bitcoin before showing you how to buy it. First place: Sign up for a Bitcoin Wallet.”

Bitcoin How does it work?

Bitcoin and other cryptocurrencies work on a technology called cryptocurrencies. “blockchain” You may have heard that blockchain is referred to as a “decentralized public ledger,” but the technology is easier to understand than it sounds. Of those words, when we say “block” and “chain” in this context we are talking about digital data (“blocks”) stored in online databases. (“chain”) This is how it works.

You have these people around the world who have bitcoin from a study in the year As of 2017, by the Cambridge Center for Financial Options, the number could be as high as 5.9 million. Assuming one in 5.9 million wants to spend one or more portions of bitcoin, this is where blockchain comes in.

With other public data loggers, such as the Securities and Exchange Commission (Wikipedia) or your local library, there are people responsible for checking out the new information, but with blockchain, the task is based on computer networks. It consists of thousands of computers. There are about 5 million (or in the case of bitcoin) of bitcoins around the world. Time of transaction, dollar amount and participants

When consumers make purchases using US dollars, banks and credit card companies verify the authenticity of those transactions. It performs the same function without these institutions using a system known as “hashing.” When a person pays for an item using bitcoin, the computers on the bitcoin blockchain rush to verify that your transaction is legitimate. Adding a new transaction to a computer blockchain must solve a complex mathematical problem known as a “hash.”

Solving the hash requires an average of 10 minutes from computers and even supercomputers. During that time, computers also verify the validity of new transactions on the bitcoin blockchain. If computers were the first to solve the hash, they would store the transactions. Newly made blocks are blocks on the blockchain, which makes them immutable.

The rate at which bitcoin can be produced halves every four years Investopedia

The rate at which bitcoin can be produced halves every four years Investopedia

Bitcoin How was it created?

When computers successfully add blocks to the blockchain, they are rewarded with We have previously mentioned that the amount of bitcoin produced every 10 minutes is halved every four years. At the time of writing, computers are earning 12.5 bitcoin, or about $48,625 USD, for each block added to the blockchain.

If the tune of $48,625 sounds tempting, be warned that the process of adding blocks to the blockchain stuff the world. In fact, the odds of solving one of these problems on the Bitcoin network are about one-seven trillion (12 zeros), to give that number a view of chance. To win the lottery, the jackpot is one in 13 million. To solve complex math problems in those odds, computers must run programs that require a lot of power, energy, and money.

Like winning the lottery, hash fixing is primarily based on chance – but there are ways to increase your chances of winning in both races. Another mining task has almost everything to do with how fast your computer can produce hashes Ten years ago Bitcoin mining was possible on normal desktop computers.

Over time, miners realized that graphics cards commonly used for video games were more efficient at mining than desktop and graphics processing units (GPUs) that came to dominate games. In 2013, Bitcoin miners began using A computer designed specifically for mining. cryptocurrency as powerful as possible, known as application-specific integrated circuits (ASICs). These can run from $500 to tens of thousands.

Today, Bitcoin mining is so competitive that it can only be profitable by the most modern ASICs, when using desktop computers, GPUs, or older ASICs, the cost of power consumption is higher than the actual revenue. The newest unit at your disposal, one computer, is hardly enough to compete with what miners call “miners.”

A mining pool is a group of miners that combine computational power and split the bitcoin mined between participants. A disproportionately large number of blocks are mined by pools than by individual miners. July 2017 Mining Groups and Companies Represents about 80% to 90% of the computing power of the bitcoin network.

In the real world, the power from millions of computers on the Bitcoin mining network is close to what Denmark consumes annually. All energy costs money, and according to a recent study from research firm Elite Fixtures, the cost of Mining a single bitcoin varies greatly by location, from just $531 to $26,170. Based on the average utility bill in the US, that figure is closer to $4,758.

Getty Images

What Bitcoin do I want to buy?

1. Digital Wallet:In order to transact on the bitcoin network, participants need to run a program called a “wallet”. The bitcoin will not be an actual wallet . The leather wallet is made of two different cryptographic keys, a public key and a private key.

The public key is the place where transactions are deposited and withdrawn from.This is a key that appears on the blockchain ledger as a user’s digital signature, unlike the username on a social media feed.The private key is The password required to trade and exchange bitcoins in the wallet.

2. Personal Documents:The US Securities and Exchange Commission requires users to verify their identity when signing up for a digital wallet as part of its protection and repression. To buy and sell bitcoin, you will be required to verify your identity using several personal documents, including your driver’s license and social security number (SSN).

3. Secure Internet Connection:If you choose to trade Bitcoin online, use discretion about when and where you access your digital wallet It is not recommended to trade bitcoin on unsecured or public wifi networks and may make you more vulnerable to hacker attacks.

4. Bank account, debit card or credit card:When you exchange USD or another currency for bitcoin, you need to fund those transactions. Bitcoin wallet can be directly connected to card bank account. debit or credit card

5. Exchange. Bitcoin:After you set up your wallet with a payment method, you will need a place to buy it. Bitcoin Users can buy bitcoin and other cryptocurrencies from an online marketplace called cryptocurrency. An “exchange” is similar to the platform traders use to buy stocks. An exchange connects you directly to the bitcoin market where you can exchange traditional currency for bitcoin.

Bitcoin Anonymous?

Anyone can view transaction history on the blockchain, even you, but while transactions are publicly recorded on the blockchain, user identification is not. Notice that the seller’s name is included in your bank statement, however, on the bitcoin blockchain, only the user’s public key appears next to the transaction, the transaction is confidential. but not anonymous

This is a key difference, as international investigators and the US Federal Bureau of Investigation (FBI) have claimed time and time again that they can trace transactions made on the blockchain to users’ other online accounts, including wallets. Cryptocurrencies are a direct result of the anti-money laundering policies we discussed earlier.

Step one: get the wallet. Bitcoin

If you make it through the winding road of description that leads to this point, congratulations!You may be ready to buy your first bitcoin.

When it comes to choosing a bitcoin wallet, you have options. But Louis Vuitton and Gucci in the crypto world are now “software” and “hardware” software wallets. Wallets are mobile applications that connect to traditional bank accounts. These wallets allow quick and easy access to bitcoin. But the drawback is that they put your money into the hands of third party companies.

While top software wallets are reliable, popular third-party companies have crashed or hacked them in the past. Just as you don’t keep thousands of dollars in your mattress, users with large amounts of bitcoin should consider keeping them. of them safely

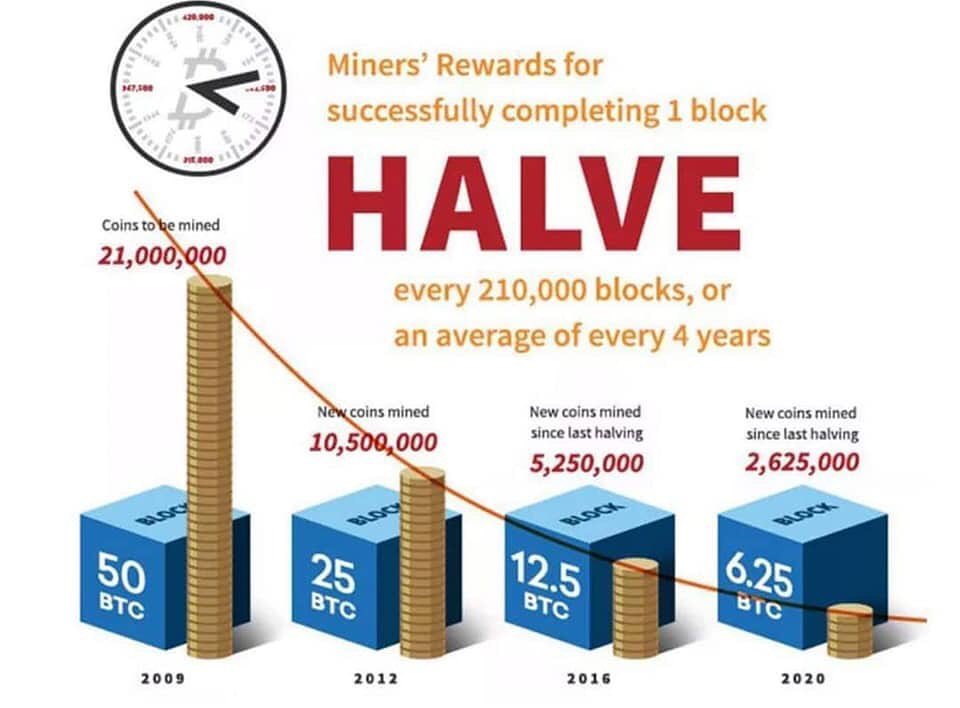

Coinbase is the most popular software wallet in the US, in part because it has a website, mobile app, and stores 98% of its customers’ currencies offline for added security. The best and easiest place to start because it connects directly to the bitcoin exchange which will make the process of buying and selling easier.

Blockchain.info is another popular wallet connected to a bitcoin exchange, but the mobile app does not support the wallet, users can also download mobile-only wallets such as Bitcoin Wallet for Android or Blockchain. Bitcoin Wallet for iOS

Hardware wallets are a bit older. These wallets store the user’s private keys on a hardware device similar to a flash drive, preventing hackers from accessing the user’s private keys over an internet connection.

Step two: Connect bank account

To buy bitcoins, you must connect your wallet to your bank account, debit or credit card, although these payment methods all perform the same function – exchanging traditional currency for bitcoin – each of which has its own fee. myself

Transactions using a bank account can take 4-5 days to process on Coinbase, but are generally recommended for first time investors, by linking your bank account to your wallet you can buy and sell bitcoin and deposit. Bank accounts are generally recommended if you’re dealing with large sums, while at the time of writing bank accounts allow users to spend up to $11,250 per week.

On the other hand, debit and credit cards allow you to buy bitcoin instantly, the drawback is that on Coinbase and other popular exchanges, debit cards can only be used to buy crypto, and even for smaller amounts, users cannot sell or deposit bitcoins. Money comes into their bank account when their wallet is connected to their debit card.

Step Three: Join the Exchange Bitcoin

Bitcoin exchanges are online marketplaces where you can exchange bitcoins for traditional currencies, say BTC for USD. Just like when you go shopping online, you have options. There’s eBay, Amazon, Etsy and Alibaba not to mention private retailers. Millions of people use these sites to sell their products.

same as buying bitcoin though two exchanges exchange cryptocurrency Same, it’s possible that they each offer slightly different services, exchanges can vary in reputation, reliability, security, forex processing fees, and cryptocurrencies As for trading, before you sit down with a meet-and-greet trade, here are our top five recommendations for getting started.

Best for Beginners: Coinbase

Coinbase is the most popular and popular cryptocurrency exchange in the United States. Only five – Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Ethereum Classic – exchanges have the means to buy and store. cryptocurrency Safely in one place Coinbase A one percent fee is charged for transactions in the United States from a bank account or Coinbase USD wallet. Purchases made using a credit or debit card are charged a percentage fee. 2.49 Coinbase also has a cash balance of up to $250,000 in the event of theft or breach in online storage.

Best for On the Go: Square Cash

The Square Cash app leads the way in peer-to-peer money transfers alongside Venmo-owned. PayPal Cash app comes from Square, the company that makes mobile credit card readers. Square is a large financial technology company with many other services, one of which is trading. The bitcoin cash app allows users to buy and sell bitcoin with no processing fees. Unlike most online exchanges, the bitcoin cash app stores your bitcoins in your Square Cash account instead of a separate cryptocurrency wallet. However, if you’re concerned about As a security, you can send the bitcoins in your Square Cash account to another wallet of your choice. Square limits purchases at $10,000 per week, but there is no limit on what you can sell.

Best for Bitcoin on a Budget: Robinhood

Robinhood was launched in 2013 as a no-fee stock broker, in February 2018 the company expanded into the bitcoin market. and ethereum, along with market data for 15 other currencies, allowing users to trade cryptocurrencies without fees. In the case of Square, Robinhood stores bitcoin in the same Robinhood account it uses for Robinhood stock. It’s mobile-first and only recently added a web version, so it’s best for people who conveniently manage their money from their phone or tablet.The downside of trading bitcoin on Robinhood is the app. This application is available in 17 states as of February 2019.

Best for Big Spenders: Coinbase Pro (formerly GDAX)

If you feel comfortable trading on Coinbase and want to increase your trading volume, you may be ready to switch from Coinbase to Coinbase Pro, formerly known as Coinbase Global Digital Asset Exchange (GDAX). Similar to the terminal of Bloomberg and active stock, commodity and options trading platform Coinbase Pro offers the option to place market orders, limit orders and stop orders in addition to traditional buy and sell. exchange between cryptocurrencies Instead of trading only from USD to cryptocurrencies, say between ethereum and bitcoin, Coinbase Pro charges a fee ranging from 0.10 to 0.30 percent based on your trading volume. If you want to try Coinbase but have higher volume then this platform is the way to go.

Best for Digest: Binance

Binance may be your best bet if you are looking for portfolio diversification. cryptocurrency Your online exchange supports multiple currencies and more cryptocurrencies including bitcoin, ethereum, ethereum classic, litecoin, ripple, bitcoin cash and cryptocurrencies. with so much experience that you may not have heard of before, so many exchanges that trade cryptocurrencies Many of these charge higher fees, but Binance charges a fixed exchange rate of only 0.1 percent for trading, although this is a platform that offers a large number of currencies at low prices. But there are some glitches reported with the Android mobile app, and some users reported delayed withdrawals for certain currencies.

Best for Cash: Peer-to-Peer

If you have a wallet But not connected to a debit or credit card bank account, you can buy bitcoin using cash through peer-to-peer exchanges, unlike conventional bitcoin wallets, peer-to-peer exchanges. It works similarly to Craigslist for cryptocurrency. This allows buyers and sellers in the same area to find each other and find one another to exchange bitcoin for cash. With peer-to-peer exchanges, it’s important to remember that you’re exchanging high-value currencies with strangers you’ve never met. Met before If you choose to trade bitcoin in this way, we recommend that you meet buyers and sellers in a highly visible public place.

Bitcoin Wallet Top Practices

Your bitcoin exchange and bitcoin wallet are not necessarily the same, while most exchanges offer wallets for security users, not their core business, if you choose to use a wallet offered by an exchange other than Coinbase, we do not recommend it. You use that exchange’s wallet to store large amounts of bitcoins or for a long time, complete your transactions and transfer your bitcoins to a more secure wallet.

Step Four: Place Your Order

One exchange, three steps and four thousand words later, you’re ready to buy your first bitcoin. It’s important to keep in mind that although one bitcoin costs thousands of dollars, bitcoin can be divided up to eight decimal places. This means you can buy 1 bitcoin for $3,890, 0.1 bitcoin for $389, or even 0.00000001 bitcoin for $.0000389 if it fits your budget.

Article Source – Investopedia.com