Binary options bonuses can give you extra money to trade sometimes for free without a deposit. But often this is an additional percentage of the amount you deposit into your account (‘Deposit Match’ bonus).

Binary options brokers are always keen to attract new traders, one of the main methods of creating new traditions is by offering bonuses, these come in many forms, from simple deposit bonuses or risk-free trades to packages. More sophisticated training and high-tech equipment – the broker knows how to attract new and old traders.

Here we list and compare all bonuses for 2020 and explain the key points to ensure that bonuses are a real benefit and don’t become a source of frustration. That’s right to get it.

Top 2020 Bonuses for UK Traders

What is Binary Options Trading Bonus?

A binary options bonus is an offer from a broker that is designed to provide traders with additional funds to trade with or to reduce losses if a trade goes wrong, usually offered in the form of a welcome bonus. Or a sign-up offer, sometimes called a welcome offer, of course, is an incentive for new clients to join that broker.

They come in a variety of formats such as:

- No Deposit Bonus

- Double Deposit

- Risk Free Trade

- Educational materials

- Hardware or Rewards

For example, a smaller ‘no strings’ bonus may be more attractive than a larger bonus which has very strict terms and conditions.

Welcome Bonus Example

Let us give an example, the most common form of bonus is Here when a new trader opens an account their first deposit triggers a bonus, this is the percentage of the deposit, so let’s say the deposit is a 50% bonus:

- Trader deposits $200

- 50% bonus (in this case $100) will be added to their account

If the deposit match bonus figure is 100%, the same trader will receive $200 in bonus funds.

Risk Free Trade

Risk-free trade is another form of bonus One of the appeals of risk-free bonuses is that the terms are usually less restrictive. An opportunity to trade knowing that if it loses they will not lose any money from their account, if it wins they will keep the profit.

Some brokers will offer 3 or 5 risk free trades and they will all operate the same way with more trades however additional conditions come in. For example when there is a risk free trade the broker has to pay. In the event that a broker offers more risk free trades, it is likely that any winnings will have to be “turned over” (traded) several times before they can be withdrawn.

This is one of the reasons why when comparing bonus terms is important, at the end of this page we explore risk free trades in detail and explain why there is always a certain level of risk.

No Deposit Bonus

The ‘no deposit’ bonus is rightly named – the bonus is credited to the account without the need for an initial deposit, obviously an attractive option for traders. But as explained above, reading the terms and conditions will be key, generally no deposit bonuses have to have a very high turnover before they can be withdrawn and this requirement must be met within a short time.

When setting the required terms and conditions, it becomes clear that the real account with The ‘no deposit bonus’ works in the same way as a demo account, the reason being that these bonus funds are not likely to be withdrawn and are not ‘real money’ until they meet strict and certain criteria.

This type of bonus is also rare, it does not work for brokers or traders, the last month has changed from no deposit bonus to crypto trading. This ‘no risk’ method allows traders to use the real money platform. But using a certain amount of trades without financial risk Brokers are now more likely to offer risk-free trades or match deposit bonuses.

The best time to get a bonus

The best time to claim the benefits is usually not on the first deposit, for some brokers it is best to open an account with the minimum deposit to reduce any bonuses. Then, after a certain period of trading, call the broker and negotiate the bonus directly with them, this is especially effective if there is a bigger investment, the higher the second deposit, the bonus terms. will be even more

If this seems like too much trouble, new traders should definitely study the potential bonus – and make sure that it will work for them, make sure that the bonus conditions can be comfortably met without. Trading behavior needs to be changed, paying special attention to turnover requirements and any time limits where time limits are required.

Terms and Conditions

There are certain issues that traders should be aware of when comparing bonuses, all of these issues are usually within certain terms, so it is important to check them out. Small print bonuses you find:

- Withdrawal Limits – Almost every bonus has these, for example there are turnover requirements that must be met and they must be met within a certain time? 100 required over 20 activations means $2000 turnover.

- Is your deposit locked? – There is some form of bonus that locks the initial deposit as well as the deposit itself so that nothing can be withdrawn until the turnover requirements are met. This is very rare – but gives investors a huge advantage. Any broker who uses these terms should be avoided altogether.

- How is the bonus paid? – Is the bonus money separate from your deposit? If so, this is usually better.

- How are the winnings paid by risk-free trades – profits are paid in cash to the account or added as bonus funds? (with its own terms and conditions)

Finding the best deals

As we’ve said, finding the ‘best’ Binary Options Bonus is a case of delving into the terms and conditions, and then you can decide if the bonus is right for your trading style. There are limited conditions, they may be worthless if those requirements are not met without you trading Small bonuses, if limited, may add value to your trading fund The biggest is not always the best when it comes. to the bonus

Finally, a quality and reputable broker will make it easy for you to cancel your bonus, some may allow you to cancel your bonus agreement, brokers who push their bonus for you may be seen as a red flag if the bonus does not. suits you, shut it down.

Why don’t you need a deposit bonus

Deposit bonuses are a common feature of binary options brokers today who use them to attract new traders to open and fund their accounts, who wouldn’t want free money? But the question is, is it really free?There are many reasons why a bonus isn’t as free as it should be and why you wouldn’t want to accept it.

Trade Minimum – Every bonus comes with a trade minimum, this is the dollar amount you must reach before the bonus can be withdrawn from your account, the minimum depends on your original deposit and the bonus, so if you deposit $2000 and Get 50% Bonus The minimum is up to $3000, on average the minimum trade is between 20 and 30 times the total account value, we have seen some as low as 15 times and as high as 40 or even 50 times. Total Account Value This means that an account worth a total of $3000 will need to trade a total of $45000 before the bonus will be yours, I like to trade 1% of my account at a time to make sure no one In a $3000 account that means trading at $30 each time $45K divided by $30 is 1500 trades. Of course you can make bigger trades to clear the minimum faster. But it can lead to serious losses.

Time Limit – Partial Deposit Bonus But not all of them have time limits, they generally take about 30, 60 or 90 days, which means you will need to reach the minimum trades before the specified time before withdrawals can be made. None of you can turn $3,000 into $45,000 but consider the opportunity to do so within 30 days. With the stars trade more often or in larger numbers than usual and increase the risk of your portfolio.

Withdrawals – Bonuses make it difficult to withdraw money from your account Some brokers who are shadier will not allow you to withdraw money until you reach the minimum trade limit Brokers that do not allow you to withdraw any part of the bonus BONUSES OR BONUS PROFIT IN NO EVENT TERMS OF THE AGREEMENT WILL ALWAYS lead you to forfeiture of all bonuses and all profits with any withdrawal before the withdrawal requirement is fulfilled, if you exchange $3,000 to $10,000 account; or $15,000 You may want to withdraw.

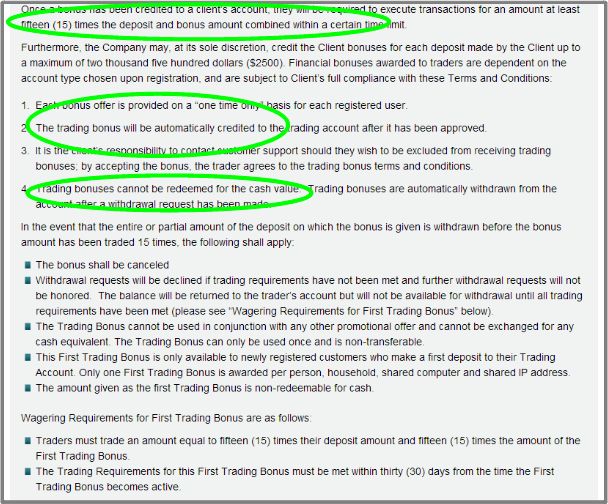

This broker (OptionYard) says that the bonus cannot be redeemed for cash, very shady value.

Free Signup Bonus – A $50 or $20 free signup bonus isn’t too uncommon these days, this is a “free” bonus you get when you sign up for an account and no deposit is required except that it may be the only way to Getting a bonus may be a deposit and then meeting the bonus requirements, you may get a deposit bonus in addition to the registration bonus, which means the bonus requirements can be very high, make sure to check what is the case with the brokers. you need

There is a reason why brokers still use bonuses as incentives, they know that the average binary options trader is more likely to lose all their money than to clear the bonus requirements, that is why the minimum requirements are so high and The time limit is very short. To meet the minimum, you may have to engage in risky trading behavior. Whenever you are contemplating receiving a bonus, please read the terms of use and fully understand how to proceed. To clear the minimum, like everything in life, not every broker is the same and each will have different policies regarding bonuses and timing, and even if the bonus is really yours.

Bonuses are usually automatically applied to the account by the broker once they have been funded, so please be aware of this if you can decline the bonus if you wish before it is delivered. They some brokers will offer other bonuses from time to time so be sure to read the terms and conditions before accepting them.

Risk in the “risk-free” bonus

There are hidden risks in risk free trading the average binary options trader is not aware of, fortunately we can reveal what to look out for.

There are clear advantages to using risk free trade, you won’t lose. But the truth is, there are still some downsides to the equation that might make you think twice about using it, following along you’ll find an explanation of some of the types of offers you might encounter and why they don’t. Risky “free” as advertised.

Free $50 Offer or No Deposit Bonus

Some brokers will give you a free $50 to start trading. Sounds great and is a potential way for traders to take advantage of the broker for demo trading purposes. Of course, $50 must be enough to place a trade. or twice

To sweeten things up, some brokers will let you know that it is possible to withdraw $50 once you meet minimum requirements and trading volume, this is not uncommon in and of itself, bonuses come with conditions but be careful Of the related “tie ins”, the minimum deposit is one of the requirements to unlock withdrawals and this is true for “no deposit bonuses”, of course you can get one, of course you can withdraw. But afterdeposits, that deposit may need to be greater than the original bonus.

Free Demo or Risk Free Trading

Some brokers offer free demos to potential clients with an email address in return, it’s not a concern for them who want to receive your email for free services.

What’s not okay is advertising a free demo and then needing a deposit to get it, that’s bait and switch, free demo if you deposit with us, worse is most of the brokers using this strategy don’t provide accounts. Give you a trial, they are pinning a “trial bonus” above your deposit and all cuts incurred, minimum amounts and tricky withdrawal requirements, we do not list brokers that do this, but they should. recognize

Rebate Program

Usually they require a certain minimum deposit, a certain minimum maintenance balance and trading volume, but here’s what you need to know – some cashback programs do. Refund only if you lost

If you are a net loser in the month you receive your loss, if you are a net winner you get nothing back, the kicker is if you are a net loser you will need to make another deposit to maintain your balance. yours (Available) Some refunds don’t require a minimum balance, you have to pay all your money to get it.

Remember that cashbacks are usually paid as bonuses – on their own terms, so they are usually not attractive at all.

Risk Free Trade

The worst risk-free offers are risk-free trades, some brokers will offer you risk free on your first, second and third trades, these come with a minimum deposit and Usually an automatic bonus

Without automatic bonus, money you will lose becomes bonus money, your balance stays the same, you trade risk free, you don’t lose money or you do?“real money” has changed to bonus money – by There are conditions attached to withdrawals, of course there are also risks.