Compare the best day trading brokers in the UK and their online trading platforms to ensure you pick the best one that is right for you, use a comparison of its spreads, market ranges and platform capabilities to decide which will help you. Maximize your profits No agent can be one of the best options all the time you should open forex account as an alternative one.

Here we list and compare the top brokers for day traders in 2020 with full reviews of interactive trading platforms, so whether you are a forex trader or want to speculate on the cryptocurrency Stocks or Indices Use our broker comparison list to find the best trading platform for day traders.

How to compare brokers

Before you find the best interactive brokerage for day trading, you should determine your investing style and personal needs – how often you will be trading in what hours to earn. Money and use of financial instruments

Then when choosing between the top rated day trading brokers there are a number of factors you can take into consideration, if you choose the cheapest you may have to compromise on the features of the platform.

There is no one size fits all when it comes to brokers and their trading platforms, the best brokers will tick all your requirements and details.

Here are some of the key points and areas to compare in this competitive marketplace:

Cost

- Do they offer a low commission rate? – As a day trader doing a lot of intraday trading, long term low commissions will bolster your overall profit

- Do they offer attractive margins? – If you can expect a higher return than the interest you pay on borrowing, the generous interest rates allow you to trade for funds you don’t have to.

- Do they have a complicated fee structure?- Brokerage fees can add up quickly, you need to look at the fine print to make sure you don’t get stung with hidden charges later, like when you Want to withdraw money Having said that, the cheapest brokers for day trading tend to make that money in other areas such as customer service.

- Will you require a minimum deposit? -Some brokers will require you to deposit large amounts of capital to open an account and start trading, for example if you are day trading at interactive brokers you will need to deposit large amounts of cash before you can work.< /li>

- Does the broker have day trading limits? – There are some limits to protect against volatility and market changes, but you can set your broker’s daily trading limits to prevent you from losing. Too many funds in one day

- Do they offer different types of accounts? – Different accounts come with different costs and attractiveness, for example choose between the Interactive Brokers Day trading account and you will get the value. Lower commissions, more leverage and improved tools for technical analysis, read more about account types here

Trading Platform Features

- Do they have modern, informative tools for research and analysis? – You will need live quotes with detailed charts and access to historical data will help you trade smarter.Top 10 online brokers. All have many tools and resources.

- How fast and efficient are their order execution, this is especially important if you are day trading because in just a few seconds you can earn a lot of cash whereas virtual brokers Many offer real-time execution, this highlights the need to test your broker first.

- How easy is their platform to use? – Broker-provided trading platforms require you to work, most brokers offer several to choose from, some will tick a box for the average day trader, others will. Offers a more advanced platform for experienced operators Does it fit your hardware – is it compatible with Mac, PC, Linux or whatever you use?

- Is there a mobile platform? – It is difficult for brokers not to deliver mobile trading apps. But quality will vary, if trading on your mobile phone is important then checking app compatibility (Android, iOS or Windows etc.) will be important.

Customer Service

- How good is their customer service? – Will you be able to get in touch with someone quickly when you need help or advice?This is especially important if something goes wrong, like a computer. Failure. Some brokers offer 24/7 customer support with less than a minute of waiting time.

- Do they have a ‘contact desk’? – The best brokers offer direct access, you don’t want to send orders to the train desk which will start in the market, this takes a long time and can Resulting in double bidding, by the time you confirm you want to continue, your opportunity may be gone.

Special

- Do they have any interesting specials? – Any £100 ‘open an account’ promotion in checkFree trading may not be everything. But that means you can iron the wrinkles on your strategy before you hit the money line. Trading without a broker means no credit, no credit for trial and error.

- Is there an account level? Does the VIP account get level II information for free or reduce spreads?

- What returns are you getting on your cash? – You will find that you have something lying in your trading account, some brokers will not give you money on that balance. But some will give 3-5%

- Trading Strategy – Can you use your trading strategy or even use automated trading, signals or copy trading at this broker?

Last word on broker comparison

Do your homework and make sure your day broker can meet your specific needs, it’s worth giving your day broker a test, set up a demo account, make sure you like the platform and submit questions. To assess how good their customer service is, get this option right and your profit will thank you.

Need a shortcut?Check out this year’s DayTrading.com award winners.

Broker Review

Use this table with broker reviews to compare all the brokers we’ve reviewed, please note that some of these brokers may not accept trading accounts opened from your country if we can determine that they will not accept accounts from your country. Your place will be marked in gray in the grid.

| Broker | Demo | Minimum | MT4 | Bonus |

|---|---|---|---|---|

| 24option | yes | $ 250 | yes | No |

| Alpari | yes | From $ / £ / € 5 | yes | yes |

| ATFX | yes | 100 $ / € / £ | yes | No |

| AvaTrade | yes | $ 100 | yes | No |

| AxiTrader | yes | 0 $ / € / £ | yes | No |

| Ayondo | yes | £ 1 | yes | No |

| BDSwiss | yes | 100 $ / € / £ | No | No |

| Binary.com | yes | $ 5 | yes | No |

| BinaryCent | yes | $ 250 | No | yes |

| Binomo | yes | € / £ / $ 10 | No | No |

| BitMex | yes | 0.0001 XBT | No | No |

| Capital.com | yes | £ / $ / € 100 | No | No |

| CityIndex | yes | £/$100 | yes | yes |

| CMC Market | yes | £ 0 | yes | No |

| Degiro | No | 0 $ / € / £ | No | No |

| Deriv.com | yes | € / £ / $ 5 | yes | No |

| E-Trade | yes | $ 500 | yes | yes |

| Easy Market | yes | € 100 | yes | No |

| eToro | yes | $200 ($50 in the US) | yes | No |

| ETX Capital | yes | £250 | yes | No |

| Expert Option | yes | 10 $ / € / £ | yes | yes |

| Finq.com | yes | $ 100 | yes | yes |

| Forex.com | yes | $ 50 | yes | No |

| Fusion Market | yes | No Minimum | yes | No |

| FXCM | yes | £ 300 | yes | No |

| FxPro | yes | $ 100 | yes | No |

| FXTM | yes | from $ 10 | yes | yes |

| High/Low | yes | $ 50 | yes | No |

| IC Market | yes | $ 200 | yes | No |

| IG group | yes | £250 | yes | No |

| InstaForex | yes | € 1 to € 1000 (depending on account option) | yes | No |

| Interactive Broker | yes | $ 10000 | No | No |

| Invest.com | yes | £ 0 | yes | yes |

| Investous | yes | $ 250 | yes | No |

| IQ Option | yes | $ 10 | No | No |

| Just2Trade | yes | £ 2,500 | yes | No |

| LCG | yes | 0 $ / € / £ | yes | No |

| Libertex | yes | £ / € 10 | yes | No |

| Markets.com | yes | $ 100 | yes | No |

| Nadex | yes | $ 250 | No | No |

| NinjaTrader | yes | $ 50 | yes | No |

| NordFX | yes | $ 10 | yes | No |

| Oanda | yes | $ 0 | yes | No |

| Olympic Trade | yes | € / £ / $ 10 | No | No |

| Pepperstone | yes | £200 / $200 | yes | No |

| Plus500 | yes | $ 100 | No | yes |

| Robinhood | No | No Minimum | No | No |

| Alth Bank | yes | $ 10000 | yes | No |

| Skilling.com | yes | 100 £ / € / $ or 1000 NOK, SEK | No | No |

| Spreadex | No | $ 1 | No | No |

| TD Ameritrade | yes | none | No | yes |

| TradeStation | yes | $ 500 | yes | No |

| Trading212 | yes | € / £ / $ 100 | No | No |

| UFX | yes | $ 100 | yes | No |

| VantageFX | yes | $ 200 | yes | yes |

| Videoforex | yes | $ 250 | No | yes |

| XM | yes | 5 $ / € / £ | yes | yes |

| XTB | yes | $ 250 | yes | No |

| ZacksTrade | No | $ 2,500 | No | No |

| Trading | yes | $1 to $300 (depending on broker’s options) | yes | No |

What is a trading platform?

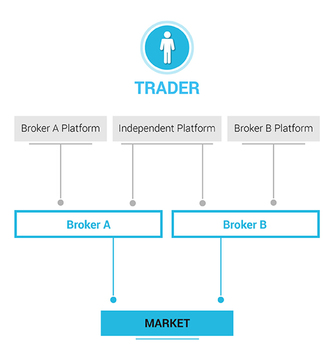

A trading platform is a piece of software that traders use to view price data from the market and to place orders with brokers. Market data can be retrieved from the broker in question or from independent data providers such as Thomson Reuters. In this section we detail how. Choose the best trading platform for day traders.

Usually, brokers offer unique trading platforms to their clients. But there are also independent platforms that can connect to multiple brokers, independent platforms can be a good option for experienced traders, while using the broker’s own platform is the easiest way to get started for beginners.

Trading Platform Features

The best day trading platforms offer a mix of features to help traders analyze the financial markets and place trades quickly, especially the most popular trading platforms offer great usability of the features. these:

- Access to Historical and Current Market Data – Day Traders must be notified of market price changes as soon as possible so they can take action before opportunities disappear or losses occur. Technical analysis and backtesting of trading strategies Not all platforms have backtesting features, so check before committing to specific software.

- Chartting and other visual aids – Trends and market sentiment are best seen through different charts.

- Order Execution – Once you decide to place a trade, immediate market execution is required. Great platform and broker to execute in less than a second. Traders using automated trading need execution. Faster is usually in milliseconds depending on strategy used and price sensitivity.

- Automated Trading – Platform with automated capabilities allows the trader to execute the market even if he/she is not at the computer at the time. The classic “stop loss” feature is a simple but automated model. Many advanced platforms that allow you to program your own trading robots to execute complex strategies or react faster than you can.

- Broker Independence (optional) – You may want to become an expert in all features of your trading platform. But there is also an option to change the broker you use.This solution is an independent trading platform (below) which can connect to multiple brokers.

Comparison of independent trading platforms

An independent trading platform is used for displaying market data and managing your trades. But it is necessary to connect to one or more brokers in order to trade the market, today’s professional trading platforms typically have a more advanced interface than the average broker and allow you to find and place trades with brokers. At least one of your choice Using an independent trading platform, you don’t need to learn all new software just because you switch to different brokers.

Independent platforms often come with advanced features such as enhanced charting and pattern analysis, automated trading, and trading alerts/signals. Different platforms have different strengths. Note – Not all brokers. This type of integration is supported with independent platforms, so use our review to find out what it does.

Trading Account

When choosing between brokers, you need to consider the types of accounts they offer, for example:

- Do they offer cash and/or margin accounts?

- Can you get a managed account?

- Do they offer a single standard account or do they offer different account levels?

The account that is right for you will depend on a number of factors such as your appetite, risk appetite, initial capital, and the time you have to trade. of it

Cash account

Most day trading brokers offer a standard cash account, this is simply when you buy and sell securities with the capital you already have, rather than using borrowed money or margin.Most brokers offer a standard cash account as a default option.

Benefits

There are several benefits to a cash account, first of all, because there is no working capital, a cash account is relatively straightforward to open and maintain, also you have less risk than a margin account because most of what you can lose is initial capital. Your principal Finally, you don’t have to pay the interest that comes with a margin account.

Disadvantage

Trading with a cash account also means that you have less chance of upside due to the lack of leverage, for example the same profit of a cash account and margin might show a 50% difference due to the margin account required. much less capital

You also have to wait for the funds to settle in your cash account before you can trade again, at some brokers this process can take several days.

Overall, the lack of margin means that these accounts may not be suitable for the majority of active intraday traders.

Margin account

Most brokers will offer margin accounts. This allows you to borrow capital to increase your position size. For example, you may pay only half of the purchase value and your broker will lend you the rest.

Margin limitations are often applied by brokers to certain securities during periods of high volatility and short-term interest rates.

Benefits

Margin accounts have several benefits, firstly, you can choose when you repay your loan as long as you are within maintenance margin requirements, secondly, you can leverage assets to expand your position size and potentially increase your rewards

In addition, interest rates are often lower than credit cards or bank loans.After all, if you have a concentrated portfolio, you may be able to use your existing securities as collateral for your margin loans.

Disadvantage

even useful With a cash account you can lose your initial capital, however, a margin call can cause you to lose more than your initial deposit. interest

You’ll also need to check the maintenance requirements, if not, you could suffer short-term repercussions resulting in liquidation of the business from claiming insurance.

Overall, margin accounts are a reasonable choice for active traders with reasonable risk tolerance.

Managed trading account

Some brokers will also offer managed accounts, managed accounts are simply capital owned by the trader. But investment decisions are made by professionals These may be called account advisors – these advisors have complete control over trading There are two standard types of managed accounts:

- Mutual Funds – With this type of account your funds go into mutual funds along with other traders’ funds, the returns are distributed between the investors, usually brokers divide these accounts. This is based on the potential risk involved, for example, those looking for a large return might put their money into a combined account with a high risk/reward ratio. Safer, the minimum investment for pooled accounts is around $2000

- Personal account – With this account your brokerYou will manage your funds individually and make investment decisions according to your needs, the main benefit is having experienced professionals on your side, however, you will pay for the privilege plus account maintenance fees and commissions. The income will require a high minimum investment of at least $10,000.

Overall, managed accounts are suitable for those with large funds. However, those with less capital and who have the time or inclination to enter and exit positions may be better off with an unmanaged account.

Account Level

Discount brokers for day trading only offer standard real accounts, however others offer multi-level accounts with different requirements and many additional benefits.

For example, a Bronze account could be an entry-level account, here you can access chat rooms, weekly newsletters, and financial announcements and reviews, these entry-level accounts have low deposit requirements.

If you want to deposit more, say more than $1000, and trade a certain amount each month, you may qualify for a Silver Account.

Deposit a little more, for example $5000 and you may qualify for an account. Gold For this you will receive:

- 10% deposit bonus

- Daily market research

- Referral Motivation

- dedicated trading advisor

- Phone access to the active trading community

Finally, some brokers will offer the highest level of accounts such as the VIP To qualify for this account, you may need to deposit above $20,000. For example, you may need to trade 500 lots quarterly.

However, for your bigger deposit, you may receive additional help including bigger deposit bonuses, free trades and other monetary incentives. You also get full access to a wide range of educational and technical resources.

Therefore, the best day trading discount brokers will offer several account types to meet your individual capital and trading needs. Only get more benefits and trading experience.

Last word in account

When choosing between brokers, you need to consider whether they offer the right account for your needs, the main factors to consider are risk tolerance, initial capital and trading.

Note, you can open different accounts if you want to use different strategies.

Regulations and Licenses

An important thing to consider when comparing brokers is the regulation, there are many different regulatory bodies around the world, and the reputation of these bodies varies. But almost all can provide a high degree of confidence to the brokers they have licensed, here are some of the leading regulators;

FCA (Financial Conduct Authority) – The UK regulator is responsible for all forms of trading and market speculation.

CFTC (Commodity Futures Trading Commission) – US Regulator Overseeing Brokers

SEC ( Securities and Exchange Commission) – US regulatory agency for exchanges and markets.

FSB (Financial Services Board) – South Africa’s regulatory body.

CySEC (Cyprus Securities and Exchange Commission) – Cyprus regulator, often used to ‘passport’ regulated brands across Europe.

BaFin (Federal Financial Supervisory Authority / Bundesanstalt für Finanzdienstleistungsaufsicht) – German regulator.

Danish Financial Supervisory Authority ( Finanstilsynet)

The European Securities and Markets Supervisory Authority (ESMA) also offers a more comprehensive approach to all European regulators, setting out some rules in Europe as a whole – including maximum leverage, negative balance protection, and the likelihood of these rules. This only applies to retail traders, not professional accounts.

How to try a free broker

Demo accounts are a great way for beginners to practice trading and test brokers or trading platforms without using real money. With market action, though, be warned – even the best practice platforms can’t simulate the pressure that comes with real money on the line. But it’s a great way to learn the basics and start with zero risks.

Read more about the demo account.

How Brokers Make Money

Even in one of the best brokers for day trading you will find different business models, having said that there are two main types:

- Market Maker

- Brokers Over-the-counter (OTC)

Market Maker

Some of the best brokers for online day trading are market makers, market makers are ready to continuously buy or sell as long as you pay a certain price, which means they may lose the price change before the price changes. Meet a buyer/seller

But of course they have to take the risk, so they set the bid a little lower than the listing price and set the ask a little bit higher.

This may seem like a small amount now, however, with tens of thousands of trades each day through good brokers for day trading that use these systems, it’s no surprise that those minute margins can add up so well.fast

Day trading brokers that use this format will normally offer fixed or variable spreads:

- FIXED SPREADS – Do not change regardless of what happens in the market, due to additional risk, fixed spreads tend to be wider than variable spreads

- Variable spreads – Fluctuates with market conditions, for example between London and New York overlaps, increasing liquidity leads to tight spreads

Let’s take an example – if you want to sell 50 shares of Tesla, good market makers will buy your shares whether they have sellers lining up or not, however they may buy those Tesla shares for $300 each. person (ask price) while offering to other traders for $300.05 (bid price), that’s $0.05 is where your online broker makes money.

OTC Broker

Many of the best discount brokers for day traders follow a business model. OTC In reality they are the most popular type of broker, the immediate temptation is the lack of trading costs and commissions, however on the best day trading platforms it is not that simple.

Basically, an OTC day broker does your part, they take your opponent’s positions, so you don’t pay commissions or similar fees, you just trade with the broker.

For example, the best OTC Futures or CFDs may cover both sides of the trade, however, the best brokers for day trading may hedge to offset the risk.

Comparison

There are several key differences between online day trading platforms that use these systems:

- Increases liquidity – The best brokers that follow the market maker model act as wholesalers, buy and sell to meet market demand.

- Price – Without market makers, the search for buyers and sellers may take longer, as a result, liquidity may decrease and you may pay higher trading fees on entry and exit. Retiring will be more difficult.

- Incentive – Market makers will make money regardless of the outcome of your trades, while OTC brokers have a stake in you that you lose.

Top brokers for day trading often use one of these patterns, check reviews to see which patterns future brokers use to get an idea of where and how they expect to make profits.

How to pay commission

Different trading brokers support different deposits and withdrawals, the availability of one or more specific payment methods can be important for traders as fees and transit times differ. Among the methods for some traders instant deposits or withdrawals may be required while others are fine with a processing time of a few days. Low transaction costs Below we will show you the different payment methods that brokers support them, along with a tutorial that covers everything a trader needs to know.

Trade in different regions

With online migration theoretically you can choose a day trading broker in India or anywhere else in the world, however there are some tax and regulatory considerations to take into account before you choose a trading platform. Day trips in Australia, Singapore or anywhere else outside your country of residence.

- Tax Considerations – Wherewhere you trade and where your broker is based can affect the type of taxes and the amount you will pay. If you start day trading with a broker from Canada, will you pay offshore and domestic taxes if you are thinking of signing up with a broker from far away? Get tax information first

- Regulations – takingControl is important for many reasons. But your financial security is one of them Opt for brokers regulated in well established financial systems like EU, US or UK A broker regulated in Bermuda is better than no regulation at all. But you may still encounter problems.

Canada and the US also have day trading rules – but they are both quite separate, read more about this on the rules page, just be aware that Canadian day trading platforms can differ significantly from both US and European platforms and platforms in South Africa will be different too.

bottom line

Which broker you choose may be your most important decision, everyone’s needs are different, so there’s no definite universal winner to turn to, so in your comparisons, consider the factors above that are most important to you. Then you will be able to find the best broker for your needs.