What is the call option?

Call options are financial contracts that give permission to buyers. But not the obligation to purchase shares, commodity bonds or other assets or instruments at a specified price within the specified period.

Important issues

- Calling is an option that is granted to the owner. But not a bond in the purchase of securities according to the specified amount at a specified price within the specified time.

- The price specified is known as the price of the strike and the time specified during the sale will expire or the specified time.

- Call options may be purchased for speculation or for sale for income. May combine to use in the spreading strategy or combination.

Basic information about the call options

For the option in the stock, the call options allow the holder to buy 100 shares of the company at a specific price called rising prices until the date is scheduled.

For example, a single call option contract may give permission to the holder in the purchase of 100 shares of Apple shares at $ 100 until the expiration date in three months. There are many expiration and prices that traders must choose. When the value of the Apple shares is higher, the price of the option contract will increase and vice versa. Optional buyers can hold the contract until the expiration date at the point where they can deliver 100 shares of the stock or sell the option contract at any point before the expiration date at the market price at that time.

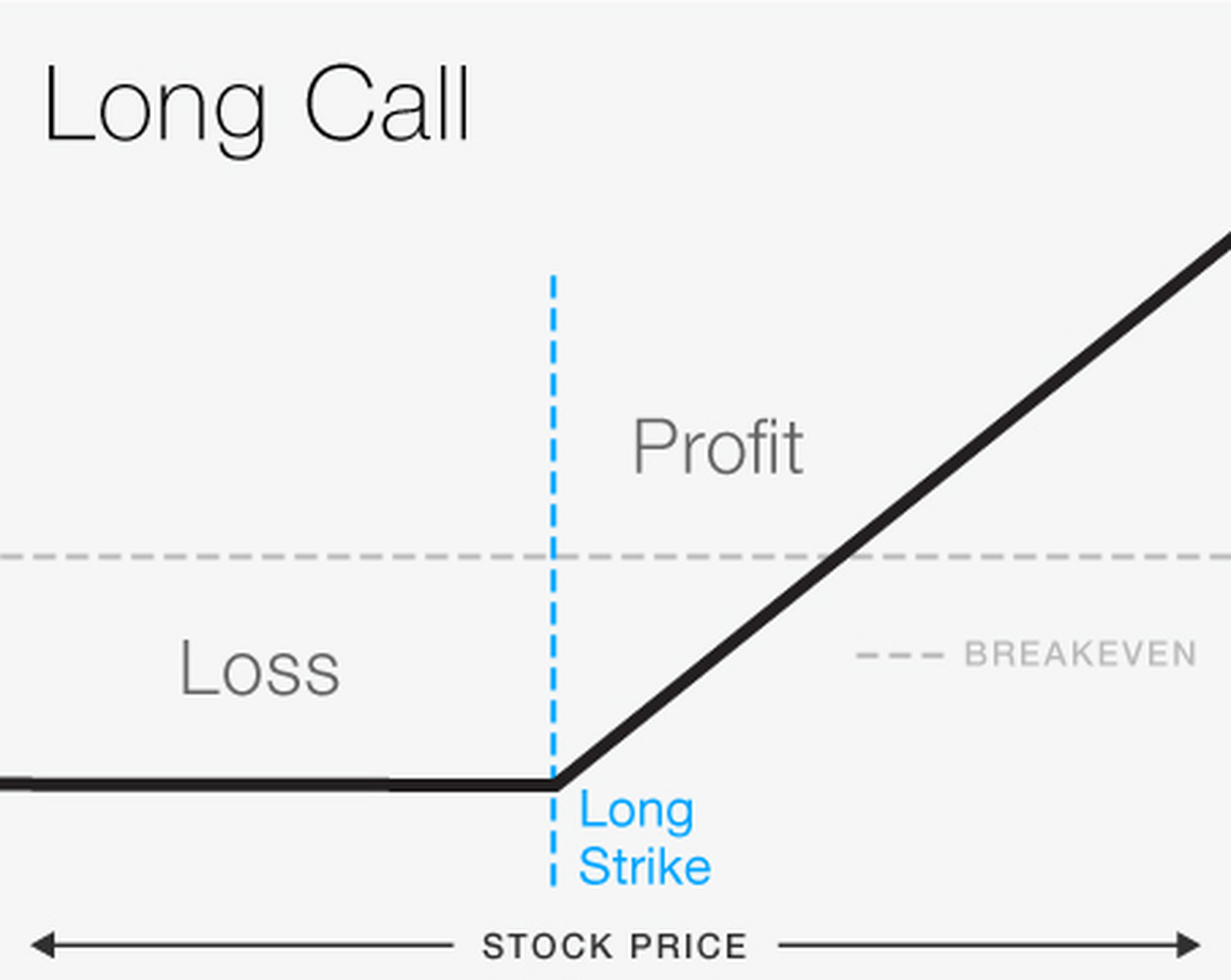

The market price of the call selection is called a premium. Is the price that is paid for the right that the call options are provided If the reference asset is lower than the right price, the buyer’s call will lose the premium paid. This is the maximum loss.

If the price of the prototype is higher than the right price at the end of the profit will be the current stock price, negative with the right price and premium. This will be multiplied by the number of shares that the user selects control.

For example, if Apple trades at $ 110, when the expiration, the exercise price is $ 100 and the option has a $ 2 buyer cost. The profit is $ 110 – ($ 100 + $ 2) = $ 8 if the buyer bought one. The contract is equal to $ 800 ($ 8 x 100 shares) or $ 1,600. If they buy two contracts ($ 8 x 200) if Apple expires under $ 100. Call options are often used for three main purposes. These are generating income, speculation and tax management.

Covering calls for income

Some investors use the call options to make money through a comprehensive call strategy. This strategy involves being a reference to the share owner. At the same time, write a call option or give permission to others to buy your stock. Investors collect premium options and hope that the option will expire worthless. This strategy generates additional income to investors. But can also limit profit opportunities If the share price is rapidly higher Is the best to consider whether you are doing a thousand or fasten during this process?

The call in the scope will work because if the stock price is higher than the right price, the buyer’s option will exercise the right to purchase shares at lower prices. Which means that the author of the option does not gain profit from the movement of the stock higher than the exercised price. The highest profit of the writer in the options is the premium received.

Use options for speculation

The option contract for the buyer has the opportunity to get a significant disclosure per share at a relatively small price. Used to separate, they can provide significant profits if the stock increases. But they can also result in 100% premium loss. If the call options expire is worthless because the reference stock price cannot move higher than the right price. The benefit of buying a call option is that the risk is always limited at the premium paid to the option.

Investors may buy and sell various call options simultaneously to create a call spread. These things will cover both gains and losses that may arise from strategies. But worth more than in some cases, more than a single call option, because the premium collected from the sale of one option will compensate for the premium paid to another using the option for tax management. Sometimes investors use options to change the allocation of a portfolio without buying or selling basic securities.

For example, investors may own 100 shares of XYZ shares and may be liable for large, unrealized funds. Do not want to cause taxable events. Shareholders may use the option to reduce the risk of security without actually selling. While earnings from calls and the options also have to pay taxes. The treatment by the IRS is more complicated because there are many types of options and variety. In the case of the above, the only shareholder who is involved in this strategy is the cost of the option contract.

Sample of the real world of the call options

Assume that Microsoft’s shares traded at $ 108 per share. You own 100 shares and want to generate higher income and higher than the dividends of the stock. You believe that the stock will not increase above $ 115.00 per share in the next month.

If the stock is higher than $ 115.00 The optional buyer will use the option and you will need to deliver 100 shares at a price of $ 115.00 per share. You continue to generate a profit at $ 7.00 per share, but you will miss the opportunity. Better than $ 115.00. If the stock is not higher than $ 115.00, you will still have stocks and extra income $ 37.