Trading the carriage options are similar to the scope options (or range) while in the scope option to two limits – one upper limit and dash. Limit the bottom one with the ladder option. In general, there will be a five price limit.

These restrictions do not have symmetrical distribution with the current price level. Means that the five limits may be lower than the current price level or 3 limits may be higher than the current price level and 2 can be reduced In general, there will be a trading limit both in risk up and down – but not always.

All price limits have two options in trading as well – ‘above’ or ‘below’ (may be displayed as ‘call’ or ‘put’ by some binary options brokers). Each limit will have a pay percentage. Different for ‘North’ options and ‘below’ percent depends on the probability of predicting the completion of the ‘money’ (correct). If the probability of prediction is actually high, paying a percentage will be less and vice versa. This is how the ladder option can create paying up to 1,000% and higher than the high payouts reflect the low probability that they will finish.

Restrictions – or ‘Rung’ – defined by brokers and cannot be changed However, the expiration time can be changed because the expiration time is fixed. Therefore changing the limit and the consistent payment opportunity.

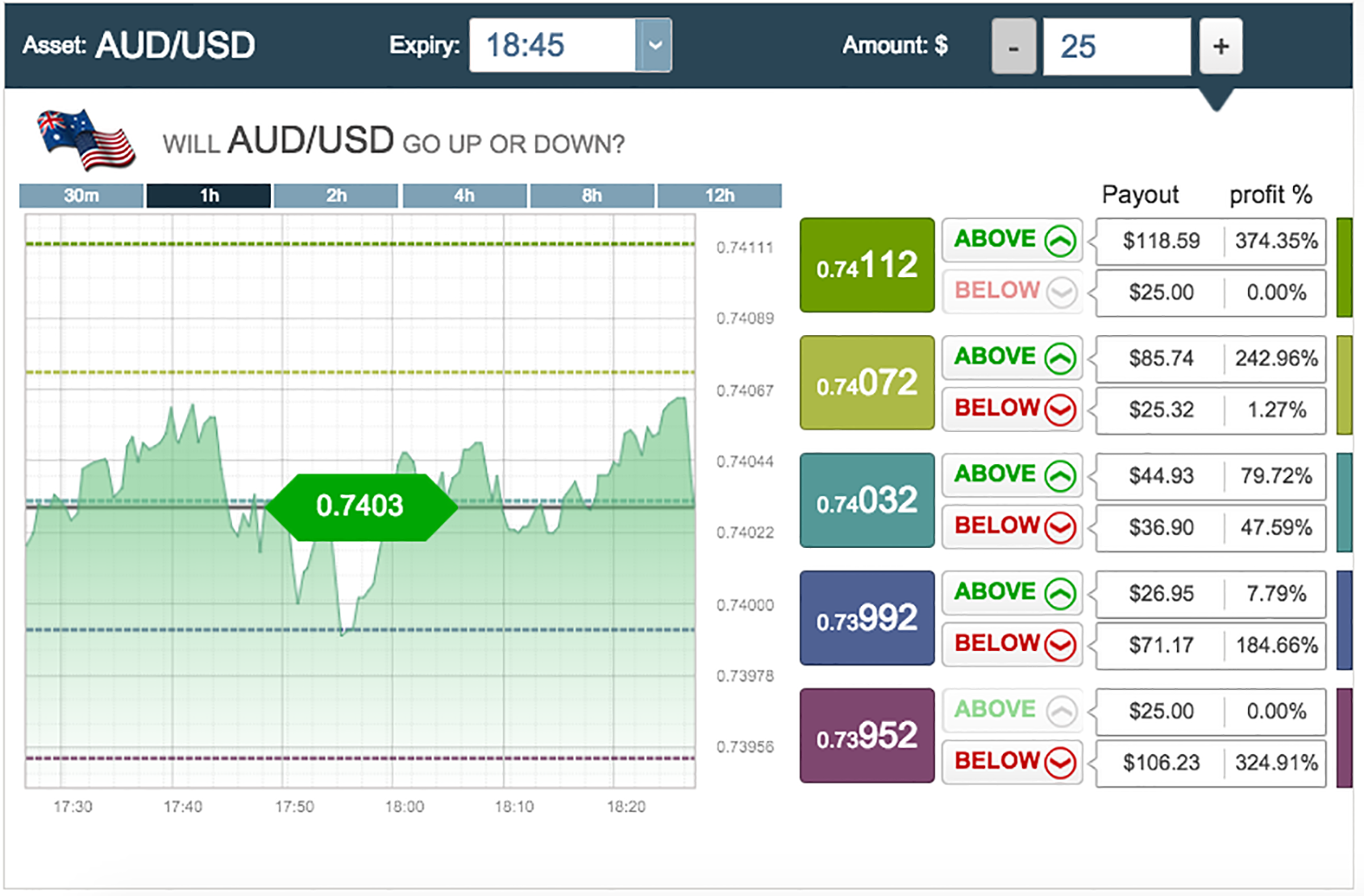

Ladder options – samples

Each value has a payment form of ‘above’ and ‘below’.

The amount paid is related to $ 25, entered in the ‘Dawn’ field on each staircase. And each must have the movement of the price from the real estate price. The more you have to move the price, it will be even more payable in the AUD / USD image. It is traded at 0.7403. If you expect the price to rise you can choose “above” at the level of 0.74112 and receive a return. 374% if you are right.

The mid-level options are paying 47% for ‘bottom’ and 79% for ‘top’ options at the top and bottom. There is only one option only – the top at the highest and lowest points. The broker sees that other results should be that they are not willing to exchange them.

Why do you need to trade the stairs?

One of the attractions of binary options is simplicity. Some traders may confirm that the ladder option recommends the layer of complexity that moves away from ‘Easy to use’ and therefore should be avoided. The view misses some important issues.

- The ladder option has a large amount of pay compared to other types of trade.

- The stairs have an alternative market.

- In the event that the trader expects to have a large price change, the ladder gives a higher profit than the standard binary options.

- The stairs are not too complicated than traditional.

- High frequency, low risk / trade, low payment is possible with stairs.

Winning trading on the stairs

Trading ladder options require market knowledge and some research. Although it is true for other trading models as well, these factors are especially important for stair trading. It is possible to win the biggest payment. But if anyone can get the correct predictions, which is probably low, up / down steepness is essential for precise predictions that will be correct. This event may occur if there are important events related to the content. For example, announcements of interest rates or profit warnings from big companies may cause sudden price adjustment. Traders need to be aware of all events to win high pay trades. Similarly, high frequency exchanges for lower payments depend on reduced fluctuations. The higher strikement rate refers to the error must be very low.

Ladder’s binary options offer other routes for traders to make profits. But they need to understand They can be used as a hedging tool or expert in their own rights. Binary options brokers have never offered steps – prices and payments must be constantly updated. Therefore, choose a broker that has the potential wisely and if the bundle is like an interesting channel for profits. Be sure to choose the appropriate broker.

Stair alternative strategy

Ladder options offer the maximum payment of all types of binary options. In effective exchange, you must have a good strategy. This article introduces you to three wonderful strategies for ladder options.

Three strategies that you will learn in this article are:

- Trading stairs depend on ATR and mobile average crossover.

- Using ATR & The ADX to make negative predictions.

- Trading resistance and support level with ladder options.

With these three strategies, you will know about three very different ways for the ladder option. By understanding the spectrum of possibilities, you will learn to adjust our strategy according to your needs and create a strategy that is right for you.

- Strategy 1: Trading stairs with ATR and moving averages

When you exchange the ladder, you face two challenges:

- Predict the market direction and

- Predict the range of the market

Dealing with both challenges with the same tool is difficult. This is why this strategy uses two tools – one tool for predicting each time.

Predict the direction of the market with the moving average

The perfect moving crossover for the direction of the market. The average move will calculate the average price of the final range and do this repeated step for all moments in your chart then they draw the results directly into the chart which creates the line.

This line moves slower than the market:

- When the market is upward, the moving average will depend on the lower time period. The moving average is higher than the market as well.

- When the market is downward, the moving average will depend on the higher the current market price. The moving average is higher than the market as well.

When the market changes direction It will change from one side of the moving average to the other side which means having to cross the moving average. Therefore, crossing the market average is an important event that indicates the market changes direction.

Predict the market with ATR

Average True Range (ATR) is an indicator of fluctuations. It measures the actual average distance that the market has moved to the past period.

Try using examples from our basic text in the ladder option. Suppose you are trading AUD and JPY with the current price of 91.226. The ladder options are 1 hour. ATR is 0.1 in a 10 minute chart, which tells you that the asset has moved the average 0.05 at the end. This value will allow you to expect that the market can move far and the target price you should use for the ladder option.

Suppose that the assets have just passed your moving average and you want to invest at a higher price. Your broker offers goals for your ladder options:

| Name | Limited price | Above paying | Below payment |

| Level 1 | 91.200 | 54.23% | 92.62% |

| Level 2 | 91.245 | 90.89% | 55.44% |

| Level 3 | 91.291 | 158.29% | 31.47% |

| Level 4 | 91.337 | 280.34% | 11.32% |

| Level 5 | 91.382 | 530.43% | 1.00% |

| Level 6 | 91.425 | 1,011.23% | 0.00% |

Which target price is the best choice for the ladder option? Try through them one by one.

- Level 1 (91.2) is lower than the current market price (91.226) when you predict the movement. This will be a very safe prediction. However, it will limit your payment to 54.23 percent. This is not enough profit.

- Price level 2 (91.245) is higher than the current market price (91.226), but not much in the moving market at a speed of 0.05. The installment will take less than one market to achieve this price because you expect to be moved up, therefore, is a very safe prediction. It will allow you to pay 90.89 percent which is better than one price level.

- Price 3 (91.291) is approximately 1.5 times the value of the ATR (0.05) from the current market price (91.226). It’s interesting. Remember: To get your ladder option The market must be traded higher than one hour target price from now. You have six moments until this happens. (Expired 60 minutes, 10 minutes chart), not every moment of the movement in the same direction, which is the reason why the market is not likely to reach the target price six times far more than the value of ATR, but the target price in the distance of 1.5 times the ATR value that has paid 158.29 percent, it seems that the bet is quite safe to make good profits.

- Price 5 (91.382) is more than three times the value of the ATR from the current market price (91.226). This is a risk prediction. The market must move in the right direction four or five times. If you are right, you will be paid like crazy at 530.43 percent, which means winning a quarter of your trading will give you a profit. Riskers like this target price.

- Price 6 (91.425) More than four times the value of the ATR from the current market price (91.226). This prediction is too risky. As you will receive a return of up to 1,011.23 percent, but almost no chance that the market will achieve this goal. It must go in the right direction throughout the hour. Stay away from this prophecy.

With these assessments, ATR helps you distinguish the target price.

- If you want to play safely, use the price level 3.

- If you want to risk using price 5.

- Traders who are looking for a good combination of risks and sales opportunities level 4.

Exchange this strategy for a while and watch your success. You will find that you like the target price ratio and ATR in our example. The ATR is equal to 0.05 and has six installments until the option expires. If every moment pointing in the same direction The market will move about 0.3. Some traders like the target price that is about half the current market price. They will invest at the price level. 5 Other traders may need a target price that is one-third away which will take them to invest at the price level 3.

Find your own perfect ratio and you’ll be able to use ATR quickly and easily to choose the right price level for your ladder option.

- Strategy 2: Using ATR and The ADX

In our previous example, we use ATR to guarantee positive – we expect which price level is currently accessible. With this strategy, we want to do the opposite: We want to predict that the price level exceeds the current movement.

We can achieve this goal without moving average. No need to have a signal. We just want to know that the price level cannot be accessed or not. But we need a little more accuracy, which is the reason why we need an average direction index.

Try using the same example earlier: You are viewing a 10-minute chart of AUD currency pairs compared to the yen currency with the current price of 91.226. Your broker offers these goals for the ladder option that has a 60 minute range:

| Name | Limited price | Above paying | Below payment |

| Level 1 | 91.200 | 54.23% | 92.62% |

| Level 2 | 91.245 | 90.89% | 55.44% |

| Level 3 | 91.291 | 158.29% | 31.47% |

| Level 4 | 91.337 | 280.34% | 11.32% |

| Level 5 | 91.382 | 530.43% | 1.00% |

| Level 6 | 91.425 | 1,011.23% | 0.00% |

Since we have a negative forecast, we must focus on paying below. The important question is the price level of the market that can reach and the price level is suitable for investment. Take a look at each price level:

- Level 1 (91.200) is lower than the current market price (91.226). This is a bad investment. When you have been paying like this, your broker expects the market to rise. Otherwise, they will not offer high payments for the forecast below. Therefore, there is no feeling of investing at a cheap price.

- Price level 2 (91.245) is higher than the current market price (91.226), but not much. The expectation that the market is trading below this price level will be reasonable when ATR has a remarkably low reading, such as 01 anything else and predict this. By paying 55.44 percent, you must win more than 65 percent of your trading. Therefore, this price level is not worth the risk.

- Level 3 (91.291) is far from the current market price (91.226) but still very close. This price level will be a possible investment if the value of ATR is very low, such as 02. Paying 31.47 percent. Interesting for negative predictions. But you have to know that you are safe forecasting here.

- Price level 4 (91.337) allows you to predict safety in most market environments, even if the ATR will read 0.3. The market will not trade over this price level when your options expire. Some traders may exchange this value with ATR at 0.4, but the relatively low payment is 11.32 percent. The percentage required to predict safely. You can win at a high rate.

- Level 5 and 6 (91.382 and 91.425), offering 1 percent payment and 0 percent respectively There is no feeling of trading such payments.

The point is difficult to choose the perfect price level according to the ATR alone. In most market environments, you can exchange five and six levels safely. But low payments make these price levels are not useful. All other price levels you must blend risks and opportunities. If you want to know how to combine these factors You must use other tools. This tool is an average direction index (ADX).

ADX estimates the strength of the market direction at the level of 0 to 100 most traders. Interpreting reading below 20 that lack of direction and reading higher than 40 is a strong direction. These values allow you to evaluate the target you should use for your ladder options:

- If ADX reads more than 40, be careful when the market has a strong direction, you have to plan for the worst thing. Suppose all moments before your options will expire in the same direction and choose the price level by paying the maximum outside of this access. In our example, there are six times until your option expires. For example, the price level 3 (91.291) is 0.65 from the current market price (91.226) when ATR reads less than 0.1. This is the selected price level.

- If ADX reads less than 20, go to the market, there is no direction. It’s time to get a high prize. Riskers may invest at the price level just as much as ATR. Read from the current market price. Moderate risk traders should use the target price that is double than the reading of the ATR twice in our example. This means that the risk recipient can invest at the level. Price 2 When ATR reads 0.05, which is quite high, others should decide between the price level 3 and 4 when ATR has lower reading. All traders can choose the price level 2.

- If ADX reads between 20 and 40 to receive medium risk when the market has a strong direction, your risk should be at a moderate level as well. Choose one method between the two examples above. For example, when ATR reads 0.02, most traders will invest at the third price level, which is a safe forecast.

- Strategy 3: Trading/Support Resistance with Ladder Options

This strategy is suitable for traders who like image signals rather than mathematical calculations. The resistance and support line is an important price level where the price of the asset cannot be destroyed.

For example, assuming that the assets are traded at a price of about £ 99, there are £ 100 barrier tests, a few times, but can not penetrate through. In this case, the barrier £ 100 will become a resistance. Similarly, when the asset is traded for about £ 101, but fails below 100 pounds, 100 pounds barriers will become a support level.

In both cases, there seems to be something that stops the assets. Not to penetrate the walls worth 100 pounds. You will not know what to stop the market. But this is not important. Obviously, traders are not willing to buy. (In the case of resistance) anymore or for sale (In the case of support) assets for £ 100.

Here are all that you have to exchange with the ladder option. When the market approaches the resistance, you wait until the first target price has a reasonable payment. Your reasonable payment definition depends on you. Most traders need at least 30 percent better than paying 50 percent before investing.

If the market is moving near the resistance/line, you may be able to invest in the same resistance/line. With higher pay most traders will use this opportunity to make money with the same prediction.

If the market penetrates the resistance or reception line, you will lose all options. You can compensate for lost money. When the market penetrates the resistance/line, the reception will fall and tend to move strongly. This is an ideal environment to invest in the stairs, the option that predicts a strong movement. You should be awarded the stairs easily by paying 200 percent which can compensate for your loss.